Remember, remember, the Fifth of November! For that’s the day the 455th edition of Charlottesville Community Engagement was published primarily through an email newsletter but possible through a mobile application. I’m your host Sean Tubbs, and if I could summon one famous intellectual from the 20th century, it might be Marshall McLuhan so I could ask: What happens when the message comes through many media? Either way, let’s get on with this program.

On today’s program:

The federal government reports more jobs were added to the economy in October, but so too did unemployment claims

Albemarle Supervisors are briefed on spending on affordable housing and agree to pay $200,000 to keep an emergency homeless shelter open through the end of next April

Epidemiologists continue to keep an eye on new COVID strains at the same time flu and RSV are both on the rise

The two candidates in Virginia’s Fifth District answer questions about taxation from the Chambers of Commerce of Charlottesville, Danville, and Lynchburg

First shout-out: JMRL to hold Food for Fines drive

In this first subscriber-supported shout-out: Be a hunger hero! Bring an item to the Front Desk of any JMRL location during business hours between November 7 and November 19 and receive $1 off overdue fines and late renewal fines for each donated item. Some of the most needed items are:

Boxed mac & cheese

Pasta and rice - whole grain

Canned tuna and chicken

Paper Products

Baby food, formula, and diapers

Donations from most branches will go to the Blue Ridge Food Bank, though those in Louisa County will go to the Louisa County Resource Council. For more information, visit jrml.org.

Bureau of Labor Statistics: Jobs up, unemployment up

The federal agency that tracks many metrics in order to provide markers of economic activity released two new numbers for October yesterday morning. The Bureau of Labor Statistics announced that nonfarm employment increased by 261,000 and the national unemployment rate also increased to 3.7 percent.

“Monthly job growth has averaged 407,000 thus far in 2022, compared with 562,000 per month in 2021,” reads the release. “In October, notable job gains occurred in health care, professional and technical services, and manufacturing.”

Employment in health care increased by 53,000 across the country with 43,000 new professional and technical services and 32,000 new manufacturing jobs.

The unemployment figure is 0.2 percent above September to a total of 6.1 million people. This figure has fluctuated in the same basic range since March.

“The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 60.0 percent, were about unchanged in October and have shown little net change since early this year,” reads the press release.

The release notes that those figures are below the values from February 2020, the month before the pandemic. For details on the exact definitions, definitely read the release which also states that Hurricane Ian did not have an effect on either number.

Data on individual states will be released on November 18.

Supervisors approve $200K to Premier Circle emergency homeless shelter through end of April

In recent years, both Albemarle and Charlottesville have increased the level of funding that goes to pay for initiatives to subsidize the cost of housing for households below certain income levels. Albemarle’s housing policy manager provided an update to the Board of Supervisors at their meeting on November 2.

“Looking at overall funding activity in [fiscal year] 2022 and [fiscal year] 2023, the Board has approved about $11.5 million in funding across many different funding streams,” said Dr. Stacy Pethia.

Pethia said those funds represent assistance for around 2,000 households or individuals with help manifesting in many forms including contributing to the preservation of existing housing as well as shelter for victims of domestic violence.

All of this stems from the adoption of Housing Albemarle in July 2021 as part of the Comprehensive Plan.

Around a third of that $11.5 comes from the Housing Fund Reserve and there were two additional requests before Supervisors on November 2.

“The first is from the Blue Ridge Coalition for the Homeless and that is in the amount of $200,000 and this is to support the continuation of emergency shelter services at Premier Circle,” Pethia said.

Premier Circle is a half-moon shaped road off of U.S. 29 that contains the former Red Carpet Inn. The Piedmont Housing Alliance bought the 3.7 acre property in March 2021 for a project involving Virginia Supportive Housing to eventually build a total of 140 units, 80 of which would provide support services to its residents.

During the pandemic, congregate shelters for the homeless were too dangerous and the existing motel has been used as an emergency option and operated by the group People and Congregations Engagement in Ministry (PACEM).

“Those individuals experiencing homelessness who have health issues that put them at high risk of complications due to any COVID-19 infection,” said Dr.Pethia. “This gave the the space to remain safely housed.”

Albemarle County has contributed $600,000 to the initiative so far. Virginia Supportive Housing hopes to break ground next spring, but until then, the plan is to keep using the former motel rooms until then. Both Albemarle and Charlottesville have been asked to contribute an additional $200,000 to cover January through April for the 84 residents who are currently there.

“Eighty-one of those residents have housing plans,” Pethia said. “In other words they have a plan to move them into permanent housing. Extending the shelter services through the end of April provides the time to move those individuals into their permanent homes.”

Supervisor Diantha McKeel asked for more information about what services will be provided to residents.

“Mainly it is housing focused case management is the best way to talk about it,” said Anthony Haro, the executive director of the Blue Ridge Coalition for the Homeless. “Main goal is to try to help people stabilize, provide basic needs, and connection to community resources whether that’s through primary health care, mental health care, connection to employment services, and financial literacy. It covers a whole range with the goal of helping someone transition out.”

Haro said various groups are searching for a permanent year-round shelter and options are being pursued. He said a stakeholder meeting will be held on December 2 to discuss funding but there are no specific sites identified just yet.

The second request was from Habitat for Humanity of Greater Charlottesville for $84,000 in matching funds for a U.S. Department of Housing and Development grant.

“It would help support the construction of four additional homeownership units,” Pethia said. “Two of those units would be built in the Lochlyn Hills community and an additional two units would be built in Old Trail.”

Supervisors approved both requests.

New strains of COVID monitored

The beginning of the holiday season comes renewed concern about infectious diseases spread through airborne contact and epidemiologists across the world and at the University of Virginia continue to monitor potential waves of respiratory illness including COVID-19.

“What we’ve seen recently is the emergence of a number of different variants,” said Dr. Costi Sifri, director of hospital epidemiology at UVA Health. “There are sublineages of Omicron that have for the first time now sort of collectively become larger in terms of a portion of cases than BA.5 which was the dominant COVID strain for some months now, for much of summer and here into the fall.”

Dr. Sifri said BQ.1 and an offshoot of BA.1.1 now make up a quarter of all new COVID strains but others are also being tracked.

“I think one common theme with these is that they have a level of immune escape compared to the immunity that’s been brought on from previous infection due to one of the earlier COVID variants including BA.5 and BA.4 and BA.2 prior to that and so that’s reflected in their relatively increased transmissibility,” Dr. Sifri said.

Dr. Sifri said the question remains what the impact of these new variants will be in terms of severity. He said people should consider getting the relatively new bivalent booster now to avoid a surge.

“The mathematically modelers including those here at the University of Virginia’s Biocomplexity Institute do sort of have a range of predictions of how large the impact will be and it really depends exactly on how much of that immune escape leads to more transmission and increased infections in communities and how that percolates into hospitalization,” Dr. Sifri said.

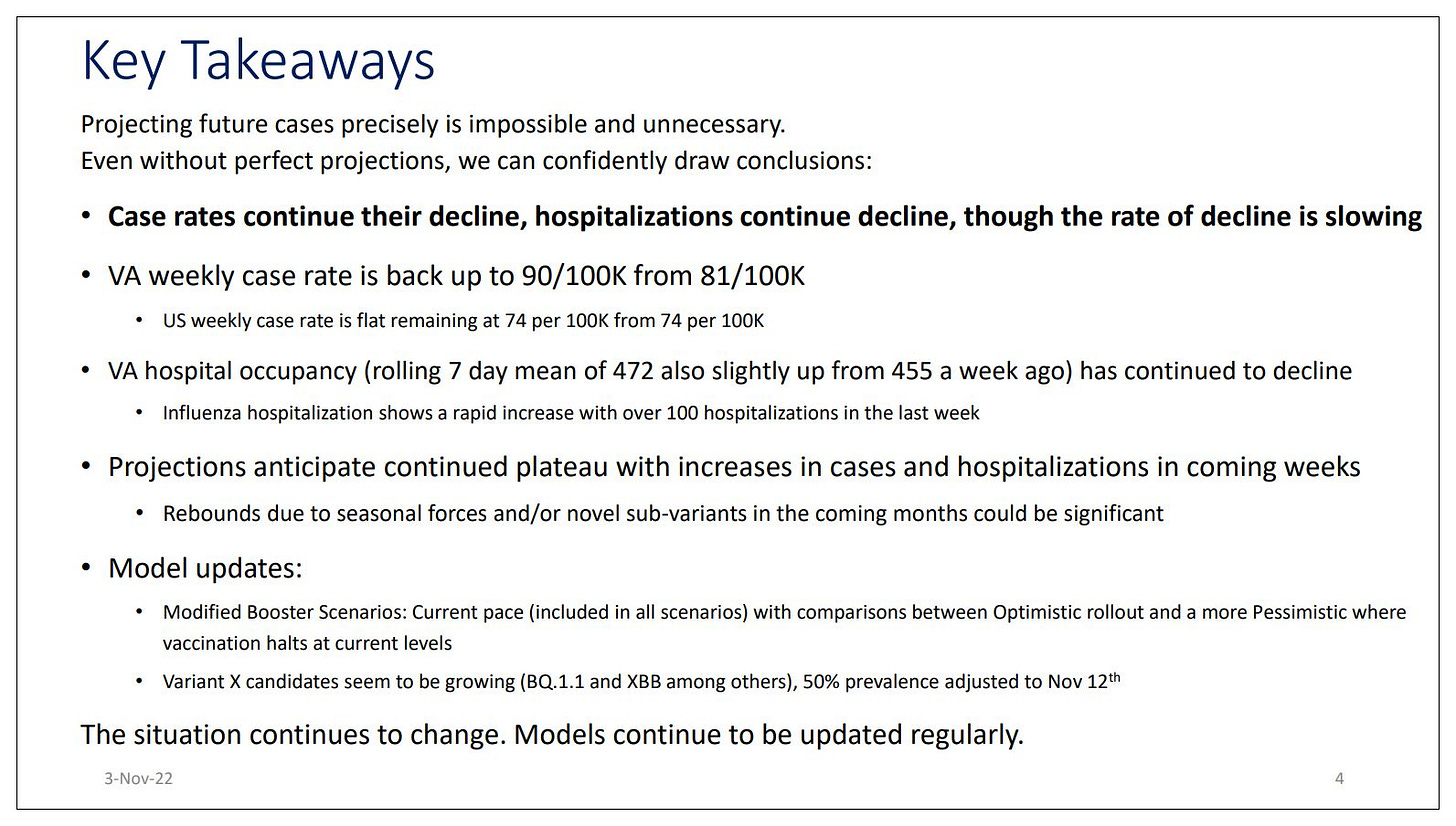

The latest model was published yesterday and has several takeaways. These are all direct quotes.

Case rates and hospitalizations across the Commonwealth remain low. But early signs suggest that Virginia may be headed into a period of new growth.

More than half of health districts are in growth trajectories, including one in surge. Only nine remain in declining trajectories.

At least three serious respiratory diseases are spreading in Virginia. In addition to COVID-19, flu levels are high in all regions of Virginia. RSV levels are also high for this time of year in Virginia. These may have a cumulative impact on hospitals and health systems, straining resources.

Dr. Sifri said the flu season has begun earlier than usual.

“This is the time to get your flu vaccine,” Dr. Sifri said. “It takes a couple of weeks for the flu vaccine to have its full effect.”

Dr. Sifri said there are a lot of challenges with RSV in people under 18 with lots of visits to pediatricians.

“Here in the Medical Center, we’re hearing about a lot of care needs in the emergency room and in the children’s hospital our pediatric beds are typically very full and it’s been difficult to get people into the hospital,” Dr. Sifri said.

In some cases, older children are being placed in adult beds in order to provide them a space.

Second shout-out: Free jazz concerts coming up week of November 15

In the second subscriber-supported shout-out, the Charlottesville Jazz Society wants you to know about an upcoming series of free concerts by Professor Bill Cole and the Untempered Ensemble. The Untempered Ensemble are artists in residence at the University of Virginia Department of Art and will give three free concerts the week of November 15th.

The group includes members of Indigenous American (Wabanaki and Nipissing), Asian-American, and African-American descent. The musicians play a wide variety of wind, string and percussion instruments from six different continents offering audiences the opportunity to form a world view of sound.

The shows:

Tuesday, Nov. 15 at 5:00 pm | Memorial to Enslaved Laborers, UVA Grounds | FREE

Wednesday, Nov. 16 at 7:30 pm | The Jefferson School African American Heritage Center | FREE

Thursday, Nov. 17 at 7:30 pm | The Dome Room of the Rotunda, UVA Grounds | FREE

For more information about Professor Bill Cole and the Untempered Ensemble, visit arts.virginia.edu.

Good and Throneburg explain positions on taxation to Chambers in the Fifth District

Three more sleeps until Election Day. As of yesterday, Nearly 790,000 Virginians have cast early ballots, a number that is more than double the 344,594 early votes cast in all of 2018. Thanks to the Virginia Public Access Project for providing that data.

The main item on the ballot across all of Virginia are elections for the Commonwealth’s eleven seats in the U.S. House of Representatives. In the week leading up November 8, I’ve been inserting segments from campaign conversations held with the two candidates in the Fifth Congressional District.

Both Republican incumbent Bob Good and Democratic challenger Josh Throneburg participated in video interviews conducted by the Charlottesville Regional Chamber of Commerce, the Danville-Pittsylvania Chamber of Commerce, and the Lynchburg Regional Business Alliance.

Previous installments were the campaign opening statements as well as a question on national security.

Here are links to the two complete videos:

Today, three questions related to taxation. There are three questions in all and they are asked by Anne Moore-Sparks, the president and CEO of the Danville-Pittsylvania Chamber of Commerce.

Question 1

“Congressman, do you support raising the corporate tax rate above 21 percent,” Moores-Sparks asked.

“Absolutely not,” Good responded. “ I am hyper anti tax, quite frankly. We do not have a revenue problem in this country. We have a spending problem… I mean ,$31 trillion national debt, the greatest percent of debt relative to our GDP since World War Two, it's causing massive inflation. It's bankrupting our future. It is one of the most critical threats to our country, certainly fiscally is our national debt and our spending. But we're collecting $4.1 trillion a year in revenue…

“The Trump Tax Cuts and Job Act of 2017 did what almost always does when we lower taxes, it almost always increases revenue. And it certainly did that again, this time, we're collecting more revenue than ever. In the meantime, we're trying to hire an additional 87,000 IRS agents to go after regular Americans to increase the number of audits on regular Americans, which are already audited, lower middle income Americans are audited five times the rate of wealthier Americans, there's not enough millionaires and billionaires to keep 87,000 new IRS agents busy. And so they'll be going after regular Americans…

“No, I'm against the raising of the corporate tax rate, but to even to prove that as far as they're gonna go after regular Americans with the IRS weaponized against citizens, as you all may know, with the Inflation Iincrease Act [sic] that was passed, the nearly trillion dollar spending boondoggle that was passed...

“In August, the Republicans had an amendment to that, that you could increase the audience of Americans making less than 400,000, because the administration said they're not going to increase taxes of those making less than 400,000. And we couldn't get one Democrat vote. And so that amendment did fail…

“But I'm absolutely against increasing taxes, we need to cut spending, we can never tax our way to prosperity, we can never tax our way to fiscal balance, there will never be enough money to do that. And we're hurting, you know, middle and lower income Americans as it is with our tax structure.

Now let’s hear the response from Candidate Josh Throneburg after hearing the question again from Anne Moore-Sparks.

“Do you support or oppose raising the corporate tax rate above 21 percent?” Moore-Sparks asked.

“So I would love to keep it at 21 percent if we can do all that we need to do. Probably where I fit into the whole political spectrum in it, you know, it would go a little bit issue by issue…

“I guess a little bit of background, just to throw in here. You know, I grew up in a very rural read conservative Republican family and community, in a world where it was just like taxes was the thing, keep taxes low, keep taxes low, keep taxes low. And I think I'm, you know, there's probably remnants of that…

“One of the things that's a little different about me, if you ever go to my main web page or something, because I talk about national debt on the first page, which most Democrats maybe don't bring up, but fiscal responsibility is really important to me. I think it's right for us to make good fiscal decisions….

“So as long as we can pay our bills at 21 percent and, you know, when we can cover the things that the the other investments that we want to make, that's fine. Again, my family has a large company, and we're always trying to figure out how do we keep those taxes down, and I understand the motivation there, so I would be fine for that at the present…

“But I also am a common sense candidate, we have to be able to afford the things that we spend. And so if there are, you know, if we have to raise taxes in order to afford certain things, let's say we were putting universal health care in and, you know, we needed to raise taxes a little bit to be able to provide coverage for that, I'm not always going to be tax opposed. But what I really, really want is to make good decisions, spend the money that we need to spend and not o waste, not to throw money away that we have to raise taxes to pay for. I think there's a huge value for me in fiscal responsibility. And then our taxes will obviously be reflective of what our expenses are. I'd love to to lower 21 to 18 if we could or you know if we were making great fiscal decisions. But that, you know, we have to have some flexibility in our tax structure.”

Question 2

And now the second question from Anne Moore-Sparks:

“Do you support or oppose increasing tax rates on corporations and small businesses as a means for paying new spending?” Moore-Sparks asked.

“I probably answered that pretty well on the last question, but you know, certainly not,” Good said. “You know, what the previous President did and lowering tax rates. You know, there's a reason why we had such a strong economy over the previous four years and why we have such a weak economy…

“Now, when it comes to all the spending, that's now we're printing money, the last $2 trillion that we spent up to $6 trillion spent in the name of China virus, cause mass caused us to have to print we can even borrow it. We've got this president has $10 trillion in new spending in his first two years, which is far and away a record for any President. [He] has grown the national debt in two years by $3.4 trillion, far and away the most of any president in two years.

“Our answer is not to further penalize Americans. We've got massive inflation that's causing them to lose purchasing power with 14 percent inflation… The inflation is even worse on the essentials like gas and in housing and cars and groceries and so forth. So the answer certainly is not to further penalize small businesses who are barely getting by.

“Think about what this administration has said to businesses… This president and his previous spokesperson, the president, [in the] State of the Union address said to businesses just lower your costs. Think about how fundamentally out of touch that is for the President to stay in the State of the Union address to tell businesses just lower your costs. The President doesn't recognize that businesses do two things every day; try to increase revenue and try to control or lower their costs. And then Jen Psaki, his previous spokesperson said that if the business passes on its cost increases, its regulatory increase costs or tax increase costs were just the cost of goods and services passes… Tthey shouldn't pass those on to their customers.

“And this administration, who has almost no business people in the administration doesn't understand that businesses don't have a printing press in the basement, like the federal government to increase revenue, they have to get it from their customers. So I'm certainly not in favor of increasing taxes.”

Then it was Throneburg’s turn.

“Do you support or oppose increasing tax rates on corporations and small businesses as a means for paying for new spending?” asked Anne Moore-Sparks.

“Generally no, but I will give one caveat to that,” Throneburg said. “I want to be a flexible thinker and responsive to what realities are. But if there are corporations that are what we call very large carbon polluters, that are pouring large amounts of carbon into our atmosphere, I am a strong believer in climate change and in human activity as a part of climate change. I believe that the costs of this country are going to continue going up and up and up and up in terms of disaster relief, what we see with, you know, fires and all of the incredible increase in costs…

“And I think that if you are somebody who is pushing huge amounts of carbon into our air, and exacerbating that issue, and increasing the costs to our country, that there should be a portion of responsibility that comes with that so…

“I would be flexible in how we address that, from a, you know, whether that was a carbon tax, or whether it was carbon incentives, or whatever it is, I'm flexible on the solutions. But I do think that if you are causing a substantial part of the problem, that you should also be a part of the solution. And so that would be the one kind of caveat to them.

Question #3

“Do you support or oppose the implementation of an annual wealth tax?” asked Moore-Sparks.

“No, absolutely not,” Good responded. “ I don't think we ought to further penalize prosperity or success. Again, when we lower taxes, it increases growth, development… Tthe rising tide does lift all boats. And I certainly actually want to cut taxes. I believe in it. I believe in the national sales tax would be best, quite frankly, I think it's a great time to advocate for that…

“And we've got the Democrats again, wanting to increase the IRS investment, the IRS, again, double the number of IRS agents, by the way, in that 80 billion that was in the Inflation Increase. Act [sic] that was passed back in August, with only Democrat votes or virtually almost no Republican votes. Of the 80 billion for the IRS, only 4 billion of that was for services, tax services processing. In other words, the IRS is far behind in processing tax refunds. But yet we've got 45 billion of it was for enforcement. In other words to go after America, they're estimating that it'll help them collect another $200 billion in taxes on top of the 4.1 trillion they're already collecting....

And then Throneburg’s response.

“ I was gonna try to get into all sorts of nuance, but that's probably not super helpful,” Throneburg said. “No, I wouldn't support an annual wealth tax.”

There will be one more installment of this segment on Monday’s edition of Charlottesville Community Engagement.

Items to read when you are done

U.S. Congress 5th District candidate profile: Josh Throneburg, Will Thomas, WDBJ-7, October 19, 2022

VA 5th District Candidate Profile Bob Good, WDBJ-7, October 20, 2022

Survey results show Nelson community shares concerns, values, Emma Martin, Nelson County Times, October 26, 2022

Prepare for new traffic pattern at 250/64 interchange, CBS19, November 4, 2022

Crozet Elementary School holds ribbon cutting ceremony for new courtyard, MaKayla Grapperhaus, NBC29, November 4, 2022

Domicile ordering comments for #455

On Friday, I sent out a message about the Substack app, which now has a chat function. I’m still not sure what that will become but there are no changes to how you receive this newsletter if you get it through email. I perhaps should have done more investigation first, but I do know that I will likely be phasing out the Twitter account for Town Crier Productions.

I do know that the next installment of this program will be an edition of the Week Ahead newsletter and there will also be a new Fifth District Community Engagement. It’s Election Day on Tuesday and I am hoping to have one last section from the Chamber of Commerce interviews as well as more information about Albemarle County.

So much information, and these summaries are fueled by paid subscribers. More than one in four of the 1,700 subscribers to this email list do in fact chip in with most on Substack. It’s a great way to support this brand of community journalism and all proceeds go for that purpose.

And of course, internet provider Ting will match your initial payment whether that be $5 a month, $50 a year, or $200 a year through Substack! You’ll get the occasional first-look at some content, and you will know that you’re helping me write and produce a great amount of material each and every week.

And even if you don’t sign up for a paid subscription to this newsletter, Ting wants your business, and if you sign up through a link in the newsletter you will get free installation, a $75 gift card to the Downtown Mall, and a second month for free. Just enter the promo code COMMUNITY.

More soon!

Share this post