One website I frequently pursue claims that March 23 is National Puppy Day, Melba Toast Day, Near Miss Day, World Maths Day, and World Meteorological Day. Whether or not these are bona fide or bananas, there certainly are a lot of interesting things to pay attention on this ever-changing planet of ours. Charlottesville Community Engagement seeks to document as much as possible in this corner of the world, and I’m your host, Sean Tubbs.

On today’s program:

Interim City Manager Michael C. Rogers recommends a two-cent increase in Charlottesville’s property tax rate to begin saving up money for school reconfiguration

Members of the public weigh in on the FY23 budget and that tax rate

A new schedule has been set for a federal lawsuit seeking to force a House of Delegates race in 2022

Charlottesville seeks input on a traffic safety study on Fifth Street Extended

First shout-out goes to the Piedmont Master Gardeners

The first subscriber-supported shout-out today goes to the Piedmont Master Gardeners to announce their 2022 Spring Lecture Series featuring leading experts on sustainable landscaping, indigenous gardening wisdom and small fruit production at home. For two more Thursdays in March, you can buy a virtual ticket for these informative events.

On March 24 at 7 p.m., Jayesh Samtani will discuss “Home Garden Berries—Selection, Cultivation, and Growing Alongside Ornamental Plants.”

On March 31 at 7 p.m., Barbara Ryan will discuss “The New Sustainable Garden - Designing with Native Plants.”

To purchase a ticket or to learn more, visit piedmontmastergardeners.org/events.

2022 House suit proceeds

Now that a federal lawsuit seeking to force a House of Delegates race in 2022 has been sent back to the Eastern District of Virginia, Judge David Novak has provided a path forward for how the suit will proceed.

Plaintiff Paul Goldman has until Friday to file arguments for why he feels he has the legal standing to bring forward a case against the Board of Elections that challenges the constitutionality of allowing Delegates elected in 2021 to continue to serve until the end of 2023.

The Virginia Attorney General’s office has until April 1 to file a motion as to why Goldman lacks jurisdiction and to express an opinion on whether Novak or a three-judge panel on the Fourth Circuit should rule on the question of standing. Goldman would then have until April 15 to respond.

“Because the Fourth Circuit remanded this case to the District Court to address only the issue of standing, the parties shall not file any motions or other pleadings beside those listed above,” Novak wrote in his ruling. (read the March 21 order)

For more information, read Graham Moomaw’s report on Monday’s hearing in the Virginia Mercury.

City seeking input on Fifth Street safety

Charlottesville is pursuing Smart Scale funding for improvements to Fifth Street Extended as part of an overall effort to prevent future fatalities on the roadway. The city is looking at the area between Old Ridge Street and Harris Road.

“This study focuses on improvement concepts that target known needs, reduce community impacts, and address all modes in a cost-effective manner,” reads the introduction. “Projects and solutions may be considered for future funding through local, regional, state and/or federal transportation programs — but not without first getting YOUR INPUT!”

According to an information sheet on the Thomas Jefferson Planning District Commission’s Smart Scale page, there is no scope or cost estimate for the project.

“Charlottesville identified the need for a project between Cherry/Elliott and Harris Roads in the 5th Ridge McIntire Multimodal Corridor Study, in Streets That Work, and in the Bike and Pedestrian Master Plan,” reads that page. “Considerations for the application include redesigning the intersection, enhancing multimodal facilities along the corridor, improving access, and enhancing transit access, lighting, and landscape of the area.

The city has already been awarded Smart Scale funds to address the intersection of Elliott Avenue, Ridge Street, Cherry Avenue, and Fifth Street Extended. (read the application)

The Charlottesville-Albemarle Metropolitan Planning Organization’s Policy Board will discuss the Smart Scale projects at their virtual meeting on 2 p.m. Thursday. (meeting info)

Rogers recommends two cent property tax increase for CY22

Charlottesville City Council held a public hearing Monday on the real estate tax rate and personal property tax rate for the fiscal year that begins on July 1.

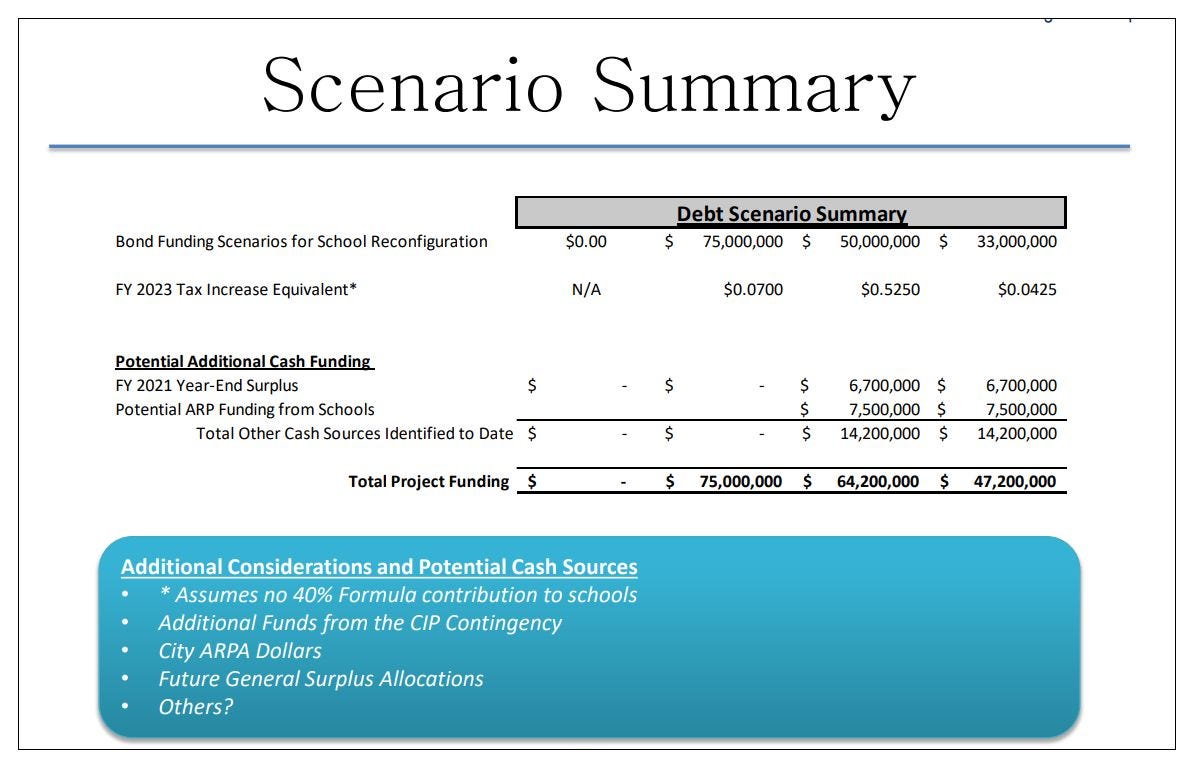

Before then and before the general public comment period, Interim City Manager Michael C. Rogers presented Council with several ways forward on raising funds in the next five years for paying up to $75 million for the renovation of Buford Middle School. (review the presentation)

“Several of you asked that we dig a little deeper and come back with several scenarios as we try to get to some resolution on how to deal with this issue,” Rogers said.

The presentation featured another lesson from Senior Budget Management Analyst Krisy Hammill about the city’s looming debt crisis.

“We have approximately $85 million that’s currently outstanding,” Hammill said.

Hamill said the city currently pays about $11 million each year for debt service and that amount would drop if no further debt was issued.

“Of this outstanding debt, about 28 percent of that is for school-related projects that have already been completed,” Hammill said.

Hammill presented multiple scenarios, all which assume an annual growth rate of 1.5 percent over the next from the real estate property tax as well as two percent in revenues from meals tax rate.

Hammill said it is the size of the project that is presenting an accounting problem. Without it, the city would expect to have a total five-year CIP of $82.4 million, requiring the sale of $46.9 million in bonds.

“With the other projects that are on the Capital Improvement Plan list, they are of such amounts that we can manage our CIP within our affordability,” Hammill said.

But adding a $75 million project will increase the total CIP to $157.4 million, requiring the sale of $121.9 million. VMDO, the architectural firm hired by the school system for reconfiguration, has suggested splitting those bonds sales over the period with $2.5 million this year, $20 million in FY24, $32.5 million in FY25, and $20 million in FY26.

“Our annual debt service payment is moving from the $11.4 million that we’ve been talking about up to about $22 million in 2032,” Hammill said. “This is roughly equivalent to about a two cent tax increase over the next four years if we were going to that incrementally.”

Other scenarios include a seven cent tax increase in FY23 in order to build up a larger reserve to pay off debt service. Another would be to reduce the city’s cost for reconfiguration to $50 million.

Kevin Rotty, a financial consultant who advises the city on long-term debt, said other options would be to reduce city spending as well as to continue exploring state funding in advance of a special session to resolve the state budget that has not yet been called.

“There’s a couple bills in the General Assembly right now which are talking about school construction,” Rotty said. “Certainly the city is not unique in having some school needs here.”

The exact funding scenario depends on multiple variables, but the main lever Council gets to control is the tax rate.

Rogers weighs in with his recommendation

Rogers reminded Council that the city will have to pick up the tab for paying 15 firefighters after a federal SAFER grant runs out. Collective bargaining will also have a cost as well.

“There are some big opportunities in transit and opportunities to make progress on our climate plan but we’ve got to add money to match the funds that are available from the [federal government and the state,” Rogers said.

Rogers had this recommendation for Council.

“The proposed school reconfiguration has not been integrated into the city’s capital improvements program in a manner that will allow City Council to make a coordinated funding plan,” Rogers said.

Nevertheless, he said there was a need to ensure that the city could cover its obligations for past needs as well as future ones.

“For the FY23 budget I recommend that Council should enact a two cent real estate tax and set the money aside within the capital projects fund earmarked as the beginning of an annual funding program to generate funds for school reconfiguration,” Rogers said.

Rogers recommended delaying a bond issue for reconfiguration for the school in FY23 until after a long-term plan could be developed. He also suggested a rehaul of the entire capital improvement program to be ready for next year’s budget.

“Let’s move forward but not too fast,” Rogers said. “Let’s take a pause and start putting away some money for this project.”

Rogers said that would give more time to see how the statewide conversation on school construction funding plays out.

Similar stories:

Council’s emphasis on housing issues reflected in proposed capital budget, December 16, 2018

Council wants more info before giving direction on capital spending, November 18, 2020

Charlottesville's Draft Capital Budget includes $50 million for Middle School reconfiguration, January 28, 2021

Charlottesville Budget staff continues to warn Council of approaching debt limit, April 1, 2021

Council discusses tax increases to help cover $60 million Buford upgrades, August 2, 2021

Charlottesville Planning Commission gets first look at FY23-FY27 Capital Budget, November 29, 2021

Prepping for Charlottesville's FY23 Capital Improvement Program, January 29, 2022

Second shout-out goes to Albemarle Charlottesville Historical Society

Today’s first subscriber-fueled shout-out is for an upcoming panel discussion on local history. The Centennial anniversary of the Jefferson Madison Regional Library is coming to an end, and staff at the Albemarle Charlottesville Historical Society will talk Thursday at 7 p.m. about an upcoming article on “JMRL at 100” in the Magazine of Albemarle Charlottesville History. ACHS Program Coordinator Sterling Howell will speak with JMRL’s Historical Collection Librarian Miranda Burnett and UVA Law Library Coordinator Addison Patrick. It’s another Unregulated Historical Meandering on the Last Word on the Library Centennial. Register on Zoom or join the program on Facebook Live.

Public weighs in on real estate tax rate, personal property tax rate, and the FY23 budget

Earlier this year, Council met its legal obligations to advertise in a newspaper of record a potential tax rate for the current calendar year.

“You authorized us to go up to ten cents which would present $9.2 million in revenue,” Rogers said.

Rogers’ recommended budget did not anticipate spending any of that funding, but left it unallocated pending Council’s discussion about whether they want to entertain a property tax rate. Rogers is recommending a two cent increase this year for the school project.

Council also advertised keeping the personal property tax rate at $4.20 per $100 of assessed value, though Commissioner of Revenue Todd Divers said a sharp increase in the value of used vehicles will increase bills. He told Council what the equalized rate would be.

“You’re looking at a rate of probably around $3.22,” Divers said. “If don’t do anything, you’re probably going to see an additional $2 million.”

Elizabeth Stark, the co-chair of the Charlottesville Democratic Socialists of America, called for the full increase of ten cents to support collective bargaining, $10 million a year for affordable housing, and other priorities.

“I ask that the city use all levers in their power to generate income,” Stark said. “Though all tax options are regressive, an increase to the property tax coupled with tax relief for low-wealth neighbors and an increase to the lodging tax seems to be the solution to me.”

However, Jamie Fitzgerald said a full increase of ten cents will hurt his ability to remain as a renter in Charlottesville.

“I rent from an owner that does not live in Charlottesville,” Fitzgerald said. “The owner performs zero maintenance on this house and the house is rapidly deteriorating.”

Fitzgerald predicted his rent would be increased to cover the cost, which would force him to vacate.

“I’m sure I’m not the only renter in Charlottesville facing this issue,” Fitzgerald said.

Chris Meyer encouraged Council to raise the property tax rate because he said Charlottesville is undertaxed.

“We need to get moving,” Meyer said. “I appreciate the city manager’s suggestion on at least a two cent raise,” Meyer said. “I would look at potentially more.”

After the tax rate public hearing, the public comment period was opened on the budget. No one spoke directly about what to do with the personal property tax rate.

Brad Slocum no longer lives in Charlottesville and now commutes in from Staunton. He urged Council to increase funding for Charlottesville Area Transit in order to help the city meet its climate goals.

“One of the best ways to do this is to ensure director of transit, Garland Williams, has the budget he and his staff need to expand the city’s bus fleet to achieve 15-minute fixed route service,” Williams said.

Brian Campbell of the Charlottesville Democratic Socialists of America called on Council to make further cuts to the police budget and to require transparency.

“Charlottesville spends $19 million annually on police,” Campbell said. “Lynchburg, a city nearly twice as big and with more officers also spends $19 million on police. On a per capita basis, Charlottesville spends more on police than Albemarle, Waynesboro, Staunton, Roanoke, Harrisonburg, Blacksburg, and Lynchburg as previously noted. Why do Charlottesville police spend so much more than their peers? No one knows.”

Katie Yared, a fourth year student at the University of Virginia, called on Council to enact a plastic bag tax for FY23.

“As I’m sure you know, the Albemarle County budget proposes that they will implement a tax on plastic bags by January 1, 2023, with a projected revenue of $20,000,” Yared said. “Following the lead of Albemarle County, the city of Charlottesville has an opportunity to significantly reduce plastic waste and to incentivize the use of reusable bags.”

Members of the Tree Commission sought additional funding in two areas.

“First, we proposed planting 200 trees per year so that we can plant more trees than are being removed,” said Mark Rylander.

That would take an allocation of $100,000 but the City Manager’s budget only includes $75,000. Rylander said the Tree Commission would like another $105,000 a year to address the destruction of ash trees by the Emerald Ash Borer.

Several speakers asked for additional funding for the Public Housing Association of Residents including its executive director, Shelby Edwards. The current level of funding for FY22 is $41,000 but the Vibrant Community process for determining funding for outside agencies only recommended $21,035 for FY23.

“Please fund PHAR especially our PHAR internship problem, and also our development-led redevelopment efforts,” Edwards said.

The capital budget anticipates spending $3 million in bond-raised funds on public housing redevelopment for each of the next four years.

There’s a Community Budget Forum scheduled for tonight night at 6 p.m. The meals tax rate will be on the agenda for Council’s next regularly scheduled meeting on April 4.

Support the program!

Special announcement of a continuing promo with Ting! Are you interested in fast internet? Visit this site and enter your address to see if you can get service through Ting. If you decide to proceed to make the switch, you’ll get:

Free installation

Second month of Ting service for free

A $75 gift card to the Downtown Mall

Additionally, Ting will match your Substack subscription to support Town Crier Productions, the company that produces this newsletter and other community offerings. So, your $5 a month subscription yields $5 for TCP. Your $50 a year subscription yields $50 for TCP! The same goes for a $200 a year subscription! All goes to cover the costs of getting this newsletter out as often as possible. Learn more here!

Share this post