When I was younger, the phrase “News You Can Use” became quite popular in television journalism. I’m not entirely sure what that was intended to convey, but I can state that much of what appears in the editions of Charlottesville Community Engagement can be described as “Information I Want To Know.” I’m Sean Tubbs, and I sincerely hope you can use some of this material.

On today’s program:

No one speaks at two City Council public hearings related to the Development Code held on a Thursday

A broad over at what’s been happening at the General Assembly

Charlottesville City Council is briefed on a potential revenue gap in the next fiscal year due to previously made decisions to increase pay for city employees

First shout-out: Bake-N-Bike with Charlottesville Community Bikes

In today’s first subscriber supporter shout-out, Charlottesville Community Bikes wants you to join them for their annual Valentine’s Day Fundraiser, Bake-N-Bike!

On Wednesday, February 14, costumed bike couriers will deliver pre-ordered bags of scones all around Charlottesville. Bags will include 6 scones (chocolate chip and cranberry) baked and packaged by Sweet Holly's Desserts, and you can add a personalized note for the recipient.

Deliveries will be made from 11 am to 5 pm. If you live outside of our delivery area, you can also pre-order scones and pick them up at Community Bikes on Wednesday, February 14. They are limited to 160 bags of scones, so order as soon as you can! Visit charlottesvillecommunitybikes.org to learn more!

Charlottesville City Council still interested in commercial uses in residential areas

The Charlottesville City Council adopted several items at their meeting on February 5, including second reading of a $4 million purchase of property owned by the Charlottesville Redevelopment and Housing Authority at 405 Avon Street.

But for now, let’s head back to the February 1 special meeting of the Council where two public hearings were held. These are mostly held on Mondays in City Council Chambers, but these public hearings were held on a Thursday in CitySpace.

The official public notice was published in the January 18, 2024 Daily Progress. A subscription is not required to review these online which are handled by a partner organization of Lee Enterprises. (view the site)

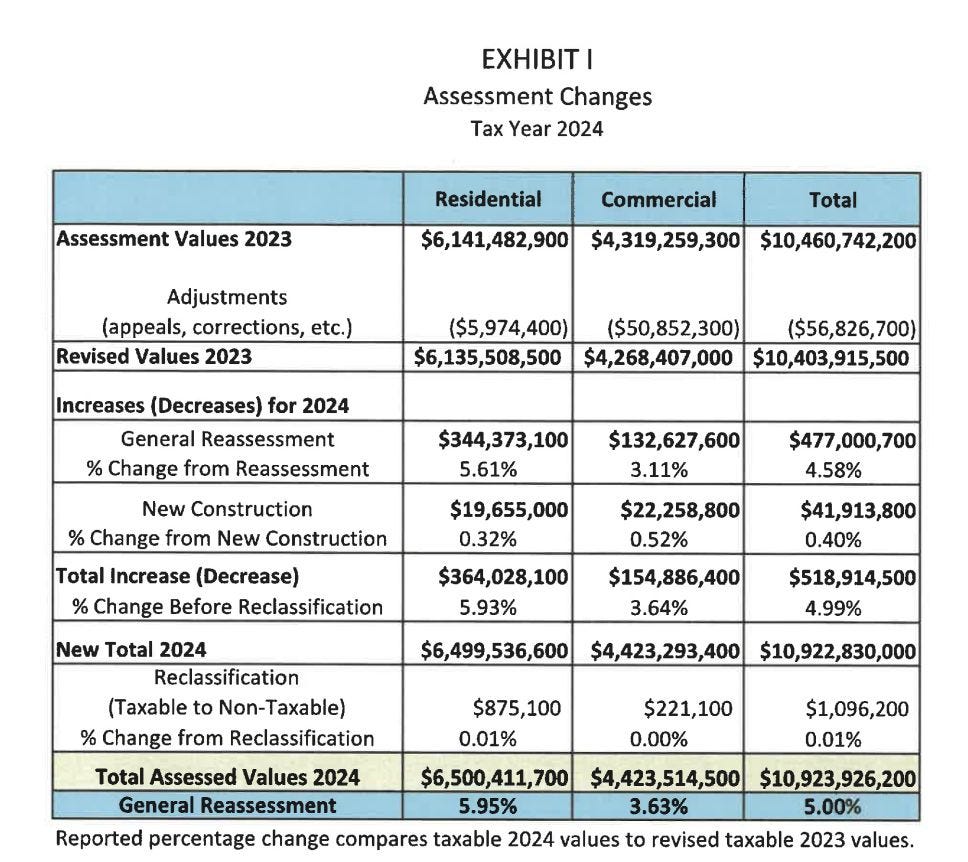

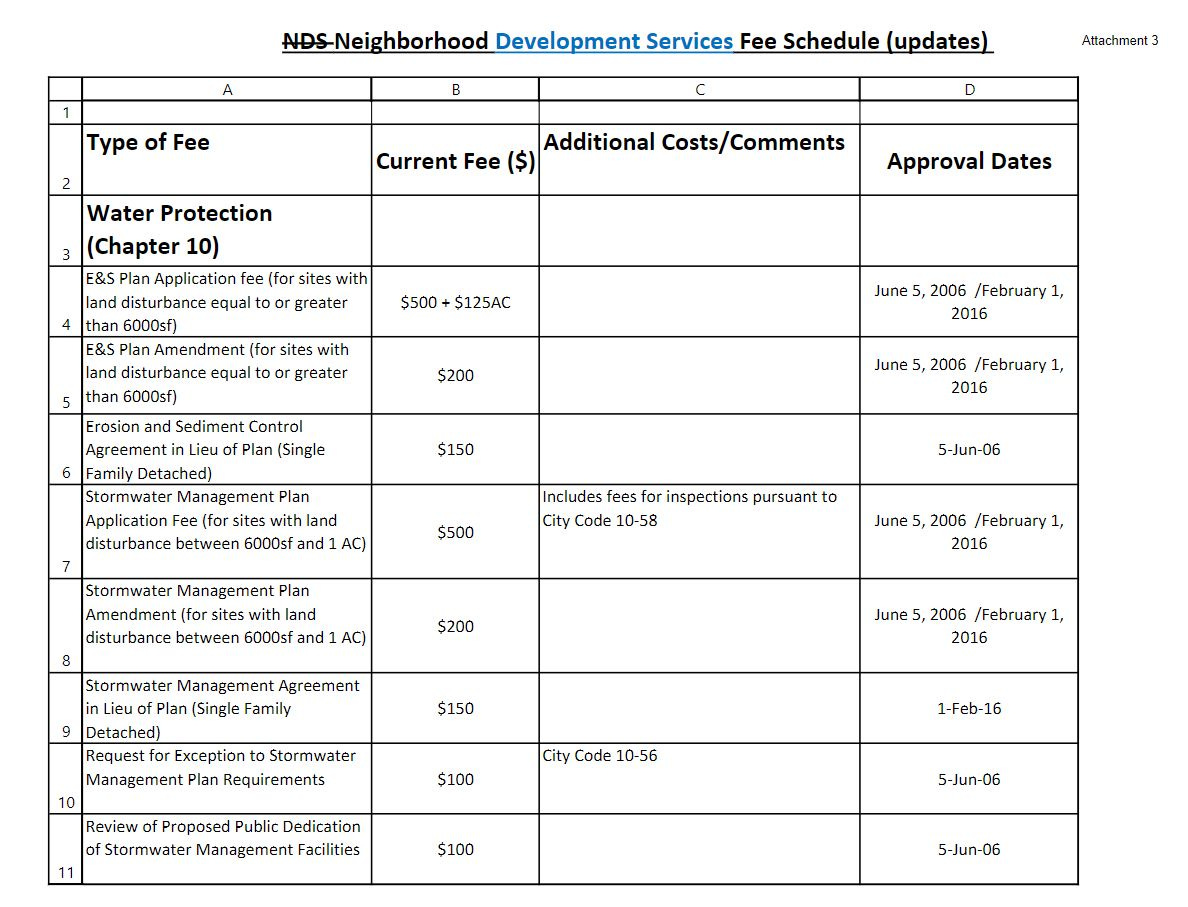

The first public hearing was on an updated fee schedule for city review of land use applications.

“We’re bringing this forward because we have this new zoning code that you all approved for us and with this we have a lot of changes to terminology,” said Missy Creasy, the deputy director of the Department of Neighborhood Development Services. “There’s a couple of new applications. There’s basically some nomenclature that we needed to get addressed to make sure that both of those documents are going to line up.”

Creasy said the fees have been kept generally the same because there was not a lot of study about what they should be, but a more formal review will happen in the near future.

The fees for NDS services are different from fees charged for building permits. Council updated those fees on April 17, 2023 after getting an introduction on April 10, 2023. (read my story)

A list of current building fees with NDS fees

No one spoke during the public hearing.

Did anyone know about it? I confess I did not put it in my Week Ahead for January 25 because when I wrote it up on Sunday, January 24, the city’s website only listed it as a budget development work session which is customary. I cannot recall a Council public hearing on a Thursday. I let myself down by not reporting this in advance and I feel I have let some of you down as well.

Council adopted the new fee schedule for NDS.

Next, Council had a public hearing on an amendment to the new Development Code on a provision that would have allowed retail under 4,000 square feet in Residential-B and Residential-C zones. Creasy said that remained in the adopted zoning an oversight caused by a “scrivener’s error."

“You all as Council at your work session on November 29 noted that at this time you all were not interested in having retail allowable in the residential areas,” Creasy said. “You all had clearly noted that and as part of our process in getting all of the corrections made, that did not enter into the document.”

Before the public hearing was opened, Councilor Natalie Oschrin wanted to reconsider the idea.

“I know that this was voted on previously,” Oschrin said. “Me in the audience watching this disagreed with the decision Council made. So, I don’t know what we do about that.”

Mayor Juandiego Wade said Oschrin wasn’t in the audience anymore and had the opportunity to have a vote.

No one spoke during the public hearing. Again, I let you down by not telling you it would be happening.

Councilor Lloyd Snook said the November 29 decision to strip commercial from residential zones put in motion a series of votes that led to adoption of the Development Code.

“And for us to revisit substantively that question upsets, at least for me, upsets the balance that we have struck,” Snook said.

Snook suggested revisiting the idea the next time the Comprehensive Plan is reviewed. Councilor Brian Pinkston said he would support reviewing the policy sooner than that after there is some discussion of the economic impacts of such a change.

City Councilor Michael Payne said he thought leaving retail in residential areas with a special use permit would be the right policy.

“I think allowing it only by special use permit was the significant compromise and keeping it in would give us the most data to evaluate how to move forward over the next two plus year,” Payne said.

Wade said he supported retail in residential with a special use permit, but he supported the compromise and voted to approve the amendment. There had been no formal vote at the November 29, 2023 work session but there had been a straw poll.

Oschrin abstained on the vote and said she wants to revisit the matter soon.

“Partly because it does take long to implement change so the more we delay, the longer it will take,” Oschrin said. “I think we can put our foot on the gas a little bit there.”

James Freas, the director of NDS, said there were other ways to address impacts of commercial businesses in residential areas. He said home-based businesses exist and he would evaluate how that process might be used to expand commercial uses. City Manager Sam Sanders said a lot of work will need to be done to implement the new system under the Development Code as it is, and he would need time to come back with more information.

The vote was 3 to 1 on the amendment with Payne voting against.

General Assembly update: A snapshot 27 days in

The General Assembly session is approaching the end of its fourth week and unlike in previous years, I’ve not been paying as much attention. This morning I thought it would be prudent to review some of what’s happening.

As this morning began, there were 2,089 bills and resolutions pending in both the House of Delegates and the Virginia Senate. Delegates had passed 362 pieces of legislation compared with 297 in the Senate. February 13 is Crossover Day when those pieces of legislation will go to the other chamber. Another 182 items had been continued to the next session.

Some of the bills that failed have simply been incorporated into other bills, such as District 55 Delegate Amy Laufer’s bill that sought to make it a misdemeanor for people to possess certain weapons in facilities that provide mental health or developmental services. HB23 was incorporated into HB861 carried by Delegate Phil Hernandez which awaits a vote in the full House after passing out of the Committee on Public Safety by a 12 to 10 vote.

The same thing happened to District 54 Delegate Katrina Callsen’s HB780 which sought to allow governing bodies of transit providers to recognize a union as a collective bargaining unit. The bill was incorporated into HB1001 and was reported out of the Labor and Commerce Committee on a 12 to 10 vote.

Many bills that have passed the House and the Senate reflect the thin margins held by the Democratic Party in both chambers. The following bills have all passed on a 51-49 vote except where noted.

HB1 would increase the minimum wage to $13.50 an hour in 2025 and $15 an hour in 2026.

HB2 would prohibit large capacity ammunition feeding devices and assault rifles.

HB84 would compel a firm conducting exploratory work for mining to meet certain public notice requirements (53-47)

HB183 would require those with firearms in residents with minors present to keep the weapons and their ammunition stored in a locked container. This would also extend to people who live with others who have been barred from possessing a firearm.

HB208 would allow localities to consider “healthy community strategies” in their Comprehensive Plan. (49-45)

HB456 would remove the state-mandated cap on salaries for members of City Councils. (64-31)

HB597 would allow localities to enforce the Virginia Residential Landlord and Tenant Act (53-45)

HB81 would eliminate the common-law crime of committing suicide (62 to 37)

Other bills have passed the House of Delegates unanimously, or close to it.

HB15 would increase to four the number of flashing lights that are allowed to be on a vehicle owned by a member of a volunteer fire company or volunteer emergency medical services agency. (98 to 0)

HB25 would establish a retail sales and use tax holiday the weekend of August 1, 2025. (98 to 0)

HB66 would require public schools to conduct a fire drill within the first ten days of a session (98 to 0)

HB71 would give an additional year for localities with combined sewer overflow systems to be compliant with Virginia and federal law, extending the deadline from July 1, 2025 to July 1, 2026. (100 to 0)

HB128 would clarify that localities with bans on door-to-door solicitation cannot extend to political activities to those bans. (98 to 0)

HB100 would increase the civil penalty for child labor law violations from $10,000 to $25,000. (98 to 0)

HB233 would reduce the threshold for Virginia Economic Development Partnership Authority grants for site development from 100 acres to 50 acres. (100 to 0)

HB477 would extend the Eviction Diversion Pilot Program to July 1, 2025. (98 to 0)

HB517 would establish the European honey bee as the official state pollinator. (98 to 0)

More from the General Assembly in the next edition of the newsletter.

Second shout out: WTJU Folk Marathon

Come gather ‘round, people, wherever you roam: WTJU’s 2024 Folk Marathon is on the air through Sunday, February 11, airing round-the-clock folk and roots specials from around the globe.

WTJU is gathering friends for a raft of musical deep dives. From Richard Thompson’s soundman Simon Tassano to local favorite Michael Clem. From Virginia Folklore Society recordings to a celebration of Kevin Donleavy’s 25 years sharing Irish and old-time music. Plus dozens of artist features and deep dives. Check out the full schedule at wtju.net!

Their sound techs are setting up mics for eight live performances in seven days. We’re excited that the line-up includes Buzzard Hollow Boys, Terri Allard & Gary Green, Mama Tried, Erik “Red” Knierim, Barling & Collins, Uncle Henry’s Favorite, and Silo! Oh, and live squeezebox!

WTJU is here for you – and your donation makes the station available to everyone! Visit wtju.net to give your support to the Folk Marathon.

Increased compensation for Charlottesville employees could mean tax rate increases

Councilors also learn more about Charlottesville assessments

More pieces are coming into place for Charlottesville’s next budget which will be presented to the City Council on Tuesday, March 5.

City Manager Sam Sanders said there is currently a gap between revenues and expenditures of between $3 million and $4 million in the draft document.

“There are what I would label and have labeled catastrophic measures that I have not taken off the table that would what I would be willing to consider in prioritizing,” Sanders said.

Sanders made his comments in the middle of a budget work session on February 1 when asked by City Councilor Michael Payne to estimate the current gap. Councilors also suggested what taxes they would be willing to raise if necessary.

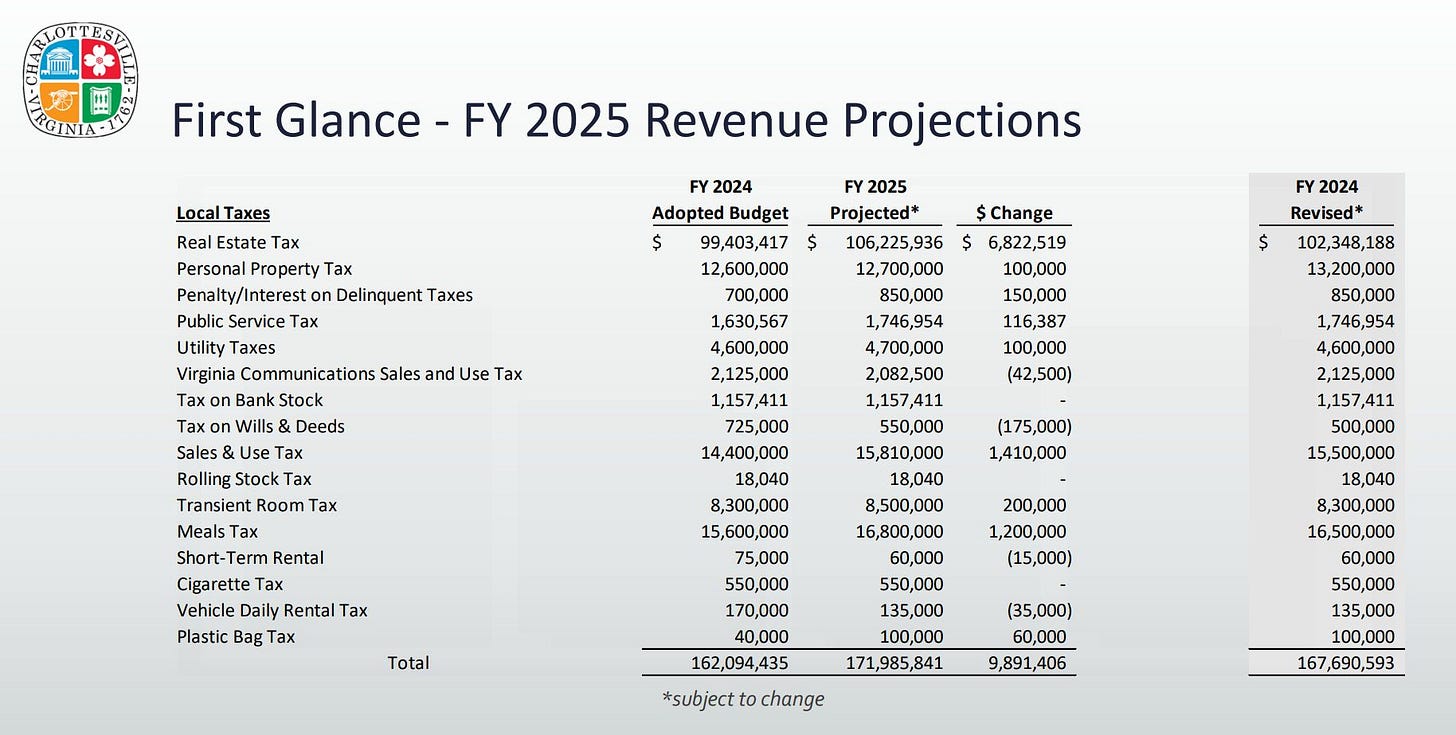

More on that in a moment. Councilors got the financial report for the second quarter of FY24 and also got a briefing on how preparations are going including the recent reassessment of real property values.

“For 2024, residential reassessments increased 5.6 percent and commercial assessments increased 3.1 percent,” said City Assessor Jeffrey Davis. “That totals a 4.6 percent overall increase.”

Notices were mailed on January 30 and anyone who wishes to dispute their assessment have until February 29 to make an appeal.

Davis said the average assessment for a residential property in Charlottesville increased to $486,300.

Davis said his office uses a Computer Assisted Mass Appraisal (CAMA) system to conduct the assessment each year.

“We use sales reports from approximately 55 residential neighborhoods and 21 commercial neighborhoods,” Davis said. “We look at those neighborhoods each year and look to see what sales have taken place within those neighborhoods. We compare those sales with the assessments and then make a determination where do the assessments lie? Are they close to what the sale price was? Or are they a distance away. And then we move groups of properties at a time rather than do individual appraisals.”

Charlottesville Mayor Juandiego Wade asked what role reported delays with the post office might play in people receiving the notices. Davis said it has not been an issue, but he encouraged people to look online.

Davis said that in 2022 there were 130 official appeals. That increased to 345 appeals in 2023, 29 of which were later withdrawn.

“Now, that’s people who have filed a formal administrative appeal rather than just calling on the phone or sending an email or anything like that,” Davis said. “One hundred and seventy-three were unchanged, 140 decreased, we made reductions in 140 of those, and we raised three of those.”

The work session was the official kick-off of Council’s role in the budget development process, with the Planning Commission having concluded their work with a public hearing on the Capital Improvement Program on January 9. (read my story)

Council also got the first glimpse of staff’s forecast for FY2025 and are anticipating an increase of $9.9 million in additional real property tax revenues, a $1.2 million increase in the meals taxes, and a $60,000 increase in revenue from the tax on plastic bags. (view the presentation)

Other items of note:

Charlottesville will collect an additional $2 million from Albemarle County through the revenue-sharing agreement for a projected total of $17,760,728.

Charlottesville anticipates over $400,000 less in revenue from Parks and Recreation

Payment In Lieu of Taxes is expected to increase by $541,637 to $7.3 million

The city is anticipating decreases in the interest rate so less revenue is anticipated in that category

“All in all, the total revenue, new money if you will that we will have to spend in the FY25 budget, is about $16.6 million dollars, so roughly a 7.26 percent change,” said Krisy Hammil, the city’s director of budget and performance management.”

Hammill cautioned that those numbers might change over the next month as the budget presentation nears. But, that figure gave Council a sense of how much funding is available for new initiatives. Before Council can get to that, there are several drivers including a projected $10 million to $12 million for employee compensation related to the new classification as well as collective bargaining and the city paying for a higher share of health care costs.

City Schools are requesting additional funds to make up reductions in state funding. There are also additional requests from nonprofit applications from what’s known as the Vibrant Community Fund.

“So those three things when you add them up, they certainly are exceeding what we have for new revenue,” Hammill said.

City Manager Sam Sanders said Council would have a tough decision ahead of them.

“With the significant expenditures that we have before us and a healthy increase in revenue of $16 million, under normal circumstances we would have been celebrating, but because we have made big decisions in regard to employee compensation specifically, it comes with a very expensive price tag attached to it,” Sanders said.

Sanders said Council may have to get to the point where they make cuts elsewhere in the budget and he has not taken that off the table as he develops the budget. The budget as it currently exists only funds $6 million of the School Board’s $12 million request above whatever the formulas says.

Sanders alluded to the catastrophic measures.

“Decisions have already had to be made and I have released a message to my lead team today so that they get this message as well,” Sanders said. “That’s no new employees, no new requests outside of what we’ve been able to integrate into the [Capital Improvement Program].”

Sanders said the classification and compensation study found out that the city was underpaying its employees, one of the reasons for turnover and vacant positions that have been partially responsible for annual surpluses

“This is about how do you run and organization, manage an organization from a healthy stance,” Richardson. “You have to pay the people to do the job. You’ve got to pay them what the market says it needs to be paid or they’ll go elsewhere to do it and if you want performance to get better, this is also a way to achieve that.”

For background, some stories I’ve written on this topic:

Charlottesville to study collective bargaining options, August 19, 2023

Council briefed on results of compensation study, April 4, 2023

Council adopts new compensation and pay scale for city employees, August 27, 2023

There are currently three collective bargaining units and Sanders said a fourth is forming.

Mayor Juandiego Wade summed up the decision facing the city.

“From what I’m hearing, we’ll have to find a way to reduce the current expenses or find new revenue sources and we have only one or two tools for that,” Wade said.

Here’s how much money would be raised by increases in the tax rate:

Each additional penny on the real property tax rate would bring in an additional $1.1 million

A one percent increase in the meals tax rate would yield just over $3 million

Every additional penny on the personal property tax rate would yield $30,238

Every additional penny on the lodging tax would bring in just over $1 million

Hammill said the budget has to be balanced in-house this week in order to meet the deadlines for advertising both the recommended budget and the eventual tax rates.

Charlottesville increased the real property tax rate in 2023 by one penny to $0.96 per $100 of assessed value. The rate had been $0.95 since 2008 after several years of decreases made at the time to contend with growing property values in the mid 2000’s. In 2003, the rate was $1.11, a figure it had been since at least 1995. (cvillepedia page with citations)

Councilor Lloyd Snook said the reduction in the rate has led the city to the situation Council currently faces.

“I thought that when we dropped our tax rate to $0.95 that we were underfunding our government, and that we were not paying for maintenance, that we were not paying our people well-paid, that we were making fundamental mistakes,” Snook said.

Snook said he would like to first see some budget cuts, but he would support an increase in the real estate tax to $1.00 per $100 of assessed value. Councilor Brian Pinkston and Mayor Juandiego Wade both said they would as well.

Councilor Michael Payne said he is open to the idea of increasing the real property tax rate as long as relief programs continue to be augmented.

“But I would say we should seriously, before even looking at the real estate tax, look at the lodging tax because I think we have strong tourism fundamentals in terms of UVA, adjacent wineries, Monticello,” Payne said. “That tax is going to disproportionately go to people of means, not living here, who are coming in to visit.”

Councilor Natalie Oschrin said she needed more information and scenarios.

“I’m not gung ho about raising any of these taxes, especially the real estate tax,” Oschrin said. “So I am interested in diving deeper into the expenditure side of things as well.”

Based on this conversation, Council did not have any interest in increasing the meals tax or the personal property tax at this time and in this year

Sanders said he will do what he can to recommend cuts to avoid the tax rate, but said Council’s meeting with the School Board on February 7 to discuss their full request. Re

This item came back up at Council’s meeting on Monday. I’ll have that information out as soon as possible, hopefully before February 7. I initially said February 8.

Reading material:

Amid slow population growth, Virginia’s demographic landscape is being transformed, Hamilton Lombard, StatChat (a publication of the Weldon Cooper Center), January 29, 2024

Home Depot inching closer to starting demolition on section of Fashion Square Mall, Sarah Allen, CBS19, February 5, 2024

Albemarle County Architectural Review Board reviews current proposals, Keagan Hughes, 29News, February 5, 2024

Report: Sluggish housing market continues across region, CBS19, February 5, 2024

UVa was awarded thousands to expand telehealth in rural Albemarle County, Emily Hemphill, Charlottesville Daily Progress (paywall), February 6, 2024

What do we do about a problem like #633?

Can a report on something that happened five days ago be called news? What if no one else has written about it? Two of the segments in today’s edition appear to fit that bill. Are there other information outlets that would have written as much? Is this worth doing?

Hundreds of you say yes, and you’re paying for me to keep building Town Crier Productions into whatever it ends up becoming. This is all built on the assumption and hope that I’ll be able to add personnel and train more people to be able to keep an eye on local government in a way that aspires to be accessible and tries to avoid the trivial.

Ting will match your initial subscription payment through Substack, whether it be at the $5 a month, $50 a year, or $200 a year level. The $200 level gets shout-outs, as does the $25 a month through Patreon tier! If you have questions, drop me a line.

And maybe you’re in the market for new Internet? Check out Ting to see what they have to offer, and if you decide to proceed, enter in the promo code COMMUNITY to receive:

Free installation

A second month for free

A $75 gift card to the Downtown Mall

Share this post