We’re well into the year now, with new people in different political roles, even though most of us are stuck in the same lives we’ve always been in. It’s February 5 and we’re now over a tenth of the way through 2022. There’s still a lot to go, so this is a good day to imagine how that other ninety percent may look. This is Charlottesville Community Engagement, and I’m your host, Sean Tubbs.

On today’s show:

It’s the first meeting for new interim City Manager Michael C. Rogers

Charlottesville City Council gets another close look for budget at the next fiscal year

Property assessments have brought in new revenue but a tax increase will be needed to cover the growing capital budget

At least three Councilors appear ready to raise the property tax by ten cents this year

Shout-out to Pen Park burial research

In today’s subscriber-fueled shout-out, work continues to identify people whose remains are buried just outside a cemetery in Charlottesville’s Pen Park. The Albemarle Charlottesville Historical Society and the Jefferson-Madison Regional Library will give an update in a webinar on Wednesday, February 9 on the Forgotten History of Pen Park: Unmarked Graves of Enslaved Persons. The panel will discuss the research thus far to identify the unmarked graves of enslaved individuals outside the Gilmer, Craven, and Hotopp family cemeteries and the connections that are being made to living descendants. Speakers include Charlottesville’s historic preservation planner, researchers and descendants. Visit the library’s website at jmrl.org to register. Also go watch the first installment from past June on the Historical Society’s YouTube page.

Council appears ready to increase property tax rate

Charlottesville City Council met for over three hours on Thursday for a work session on the city’s next budget. In an era with lots of turnover on both staff and Council, the budget remains one of the best ways to gauge the health of the city organization, at least from a financial and fiscal perspective.

Now it’s up to a new City Council to make the decisions that will lead the community forward. There are two new Councilors who have not yet been through the process of a new budget. There are three who have mostly only served during the virtual era brought on by the pandemic, a time that’s felt a little disconnected for many of us.

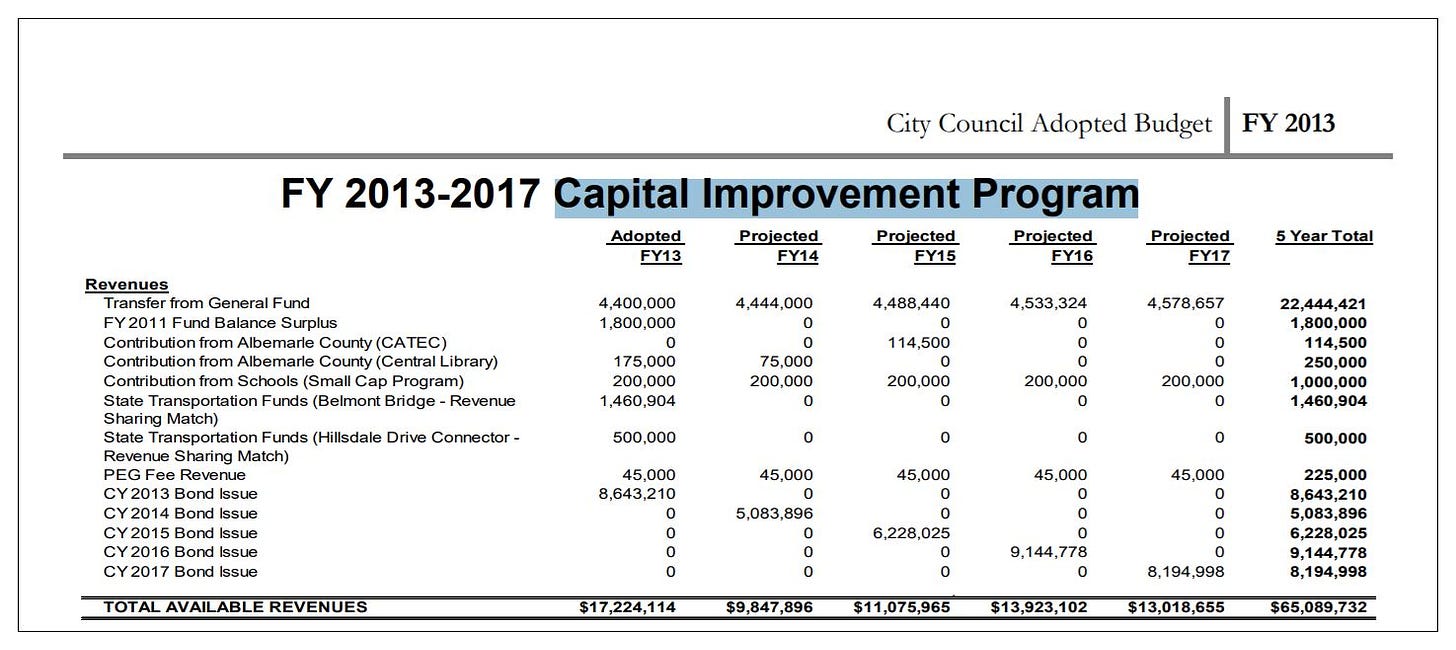

Still, the city has moved on, continuing a trajectory towards increased spending on capital projects. In FY13, the five-year capital improvement plan was $65 million. In FY2018 that had increased to $106 million. In FY22 that figure is now $159 million with previous Councils agreeing to make major investments in affordable housing as well as school reconfiguration.

But the question remains? How exactly will City Council decide how this will be paid for? The process got officially underway on February 3 at a budget work session in which the new Council stated their values and indicated their willingness to increase the property tax rate.

One of the first things was to hear from Michael C. Rogers, the new interim city manager. (watch the presentation)

“Our discussion is the first discussion about the FY23 budget,” Rogers said.

Some decisions have already been made well in advance of the official kick-off. In September, three members of this Council told budget staff to take over $18 million in the capital improvement plan that had been intended for the West Main Streetscape and put it toward a $75 million investment in city schools. They also adopted an affordable housing plan in March which calls for $10 million a year on affordable housing projects such as the redevelopment of Friendship Court and Charlottesville public housing sites.

As the budget cycle officially begins, the central question is how to pay for these decisions made by a previous Council. Now it’s up to this one to decide whether to proceed and at what cost. A majority on Council appears willing to raise the property tax rates, even in a year with near record increases in property assessments.

(Read previous stories on budget development on Information Charlottesville)

Assessments up more than normal

At the beginning of the February 3 work session, Rogers helped inform the answer with new information that had not yet been revealed. (view the presentation for the February 3, 2022 meeting)

“There has been a tremendous boost in terms of the assessed value of property,” Rogers said.

Assessments were up an average of 10.77 percent this year, according to city assessor Jeffrey Davis.

“The reassessments saw a larger than normal increase this year and that was due mainly to the overall strength of the residential market,” Davis said.

In 2022 residential property increased 11.7 percent. That figure was 4.2 percent in 2021 and 3.8 percent in 2020. Commercial property values rebounded this year.

All of the property assets added together make up what’s called the tax base. Davis said the rise in assessments from 2021 to 2022 have yielded an additional $860.8 million to the base. In comparison, the increase from 2020 to 2021 added $250.3 million to the base. These numbers will remain in flux as property owners pursue appeals. (learn more on the assessor’s website)

“We are right now in the process of handling appeals and we will be doing that,” Davis said. “The appeal period ends at the end of February and at that time we will look to prepare for the Board of Equalization which will hear appeals in May.”

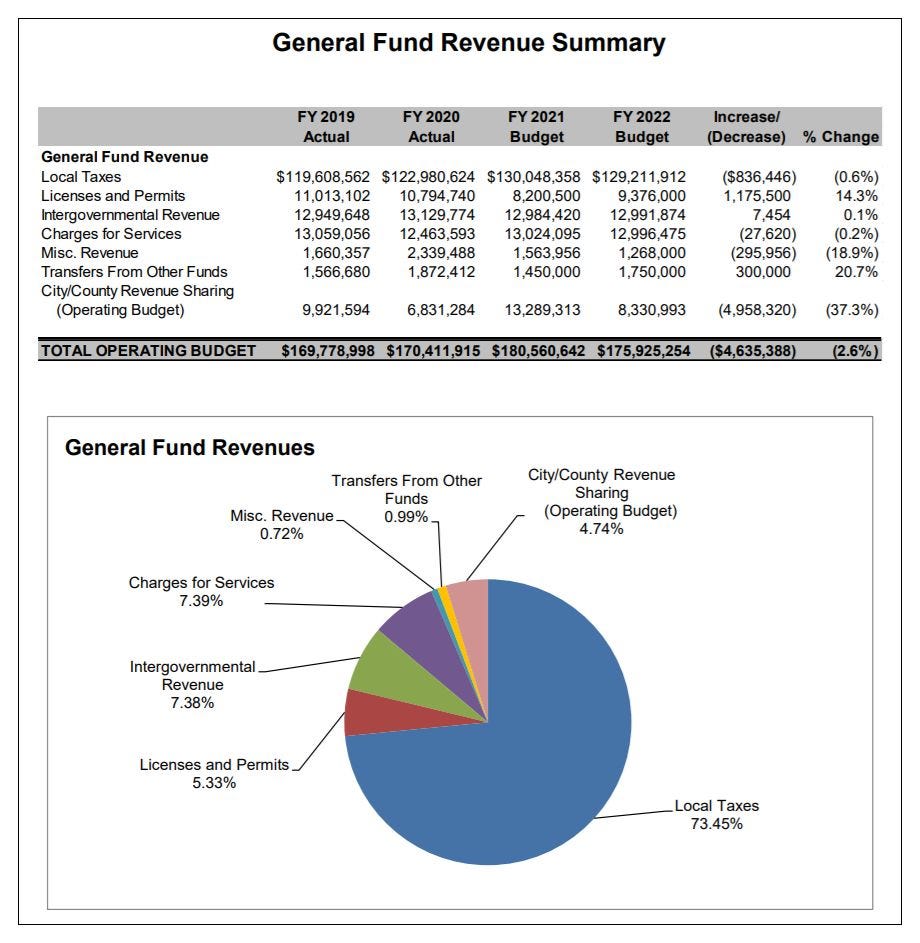

A budget is built by staff who make forecasts about how much revenue the city will bring in. Sources include local taxes, licenses and permits, charges for services, and revenue from state and federal sources. There’s also a line item for revenue sharing from Albemarle County.

But the biggest source of revenue is from property taxes. In the current fiscal year which runs through this June 30, budget staff projected $80.3 million in revenues from property taxes, or 41.8 percent of total revenues. The increase in assessments will bring in additional revenues for the current fiscal year, and will also yield additional revenue on which to build the FY23 budget.

“We are looking at a revenue increase of $14.8 million for the FY23 budget,” said Krisy Hammill, the city’s senior budget analyst.

Of that figure, real estate makes up $8.3 million of that increase, and the rest is made up through projected increases in revenues from the sales tax, meals tax, and the lodging tax. Hammill said that means the city can build a budget of $207 million for FY23, up from the adopted budget of $192.2 million.

All of this is based on an assumption the property tax rate will remain at 95 cents per $100 of assessed value. It’s been at that rate since calendar year 2008. (cvillepedia)

“As staff, we have not made any assumptions about any kind of tax increase at this point,” Hammill said.

Additional expenditures for FY23 will take up much of that $14 million

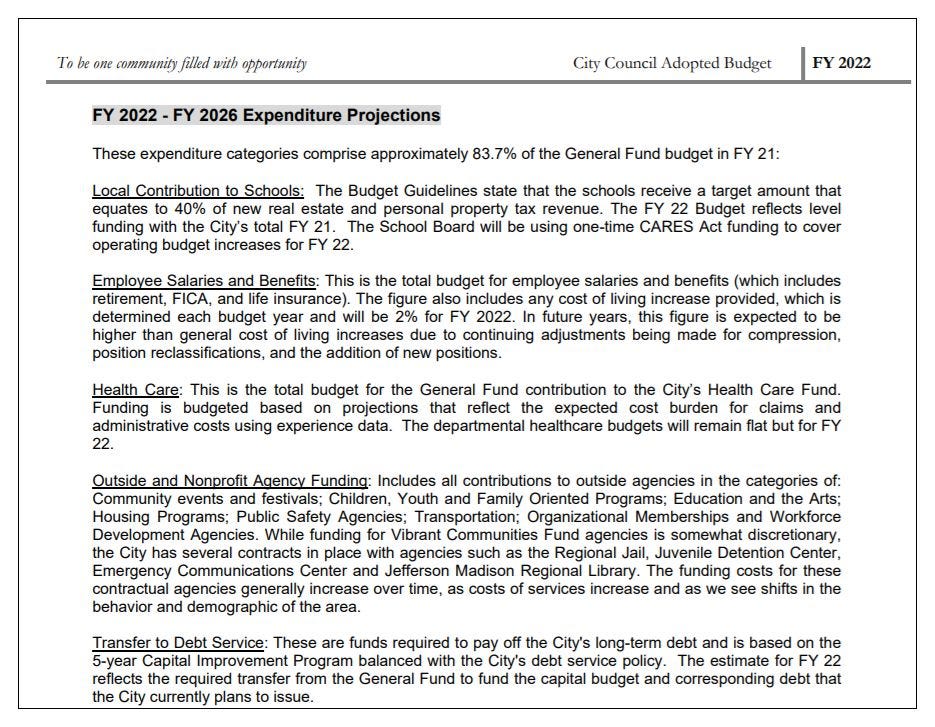

Before we get to the capital portion of the budget, another driver is further salary increases for city employees. Council agreed earlier this year to allocate the budget surplus from FY21 to cover the cost of a bonus as well as a six percent across the board increase. That means FY23’s operating budget must carry on that charge at a cost of $3.2 million and further merit pay increases are also being considered to help retain staff in an era of fierce competition.

“We have priced out here a potential three percent merit increase,” Hammill said. “That would be at a cost of $1.7 million.”

There is no budget yet but we do know that there have been $10.655 million in requests from city departments, with just under half of this in the form of new positions. Another $3 million is for compensation requests, and just under $2.5 million are for operational additions.

Specific decisions about individual line items will be made as Council goes through the budget in March. The key takeaway for Hammill’s presentation was one of revenue.

“Numberwise, it’s a good story to tell,” Hammill said. “We have $14 million in new revenue. The challenging part is that we always have more needs than we have resources and so how do we best prioritize and parse through and figure out the trade-offs?”

And that’s the task ahead for staff and Council. The budget won’t officially be presented until March 7 but until then there will continue to be lots of discussion about the capital improvement plan.

“As we move on, we know that this plan is not affordable as currently laid out without significant revenue enhancements,” Hammill said. “We have to figure out a way to pay for it.”

The debt service payment would double if all of the bonds for all of the projects were floated next year. Hammill said Council needs to review the capital budget carefully.

“If ever there was a time when priorities take a very high look, this is the opportunity to do that,” Hammill said.

Towards an inevitable tax rate increase?

The discussion of whether to move forward with a tax rate was led by Interim City Manager Rogers. He said Council does not have ready access to that $14 million made available through the assessment.

“There are some decisions that have already been made that impact how that new revenue can be used,” Rogers said. “Some of the decisions have already been made. Some of it is that we are recommending based on prior discussion that certain investments continue to be made in employees and retirees.”

The school system gets a percentage of that new revenue based on a formula, and that would yield $3.3 million. However, the school system has asked for more and staff is recommending an additional $900,000. There’s another $1 million slated for enhancements for tax relief programs, $1.8 million in equipment repair and replacement related to COVID, and other recommended uses of the money.

“At the end of the day when we look at all of the availability of revenue and all of the things that we have listed that are up for funding, there’s not a lot of money that’s left if it goes that way,” Rogers said.

Hammill said there’s about a half million left from that $14 million.

Rogers said that means that if Council wants to support that capital budget, there will need to be an increase in the tax rate.

Council discussion

Councilor Sena Magill said she is prepared to raise the rate even on top of the assessments because she said Charlottesville has one of the lowest municipal tax rates of its peer cities.

“There are some things coming up that we have to make sure that we’re, we know we have to do something about schools,” Magill said. “I know we’re also still trying to figure out reconfiguration from renovation from all of these parts and pieces. But I know we do know to sink a lot of money into our schools to bring them up to a place where the buildings are environments that are conducive to learning and good mental health.”

Vice Mayor Juandiego Wade, who served for 16 years on the School Board, said he supported additional funding for the schools.

“The cost of the schools are not going to get any cheaper,” Wade said. “If we had made some of these decisions in the past instead of $75 million maybe it would have been $60 million or $65 million. It would have been cheaper.”

Planning for reconfiguration took place during Wade’s tenure on the school board. To learn more about those decisions, visit cvillepedia.

City Councilor Michael Payne said he wanted to continue to honor the $10 million a year agreed to in the Affordable Housing Plan adopted by Council last March.

“Even if we’re not able to immediately get there this budget cycle, to have a clear plan for how we will very shortly maintain that commitment over ten years,” Payne said.

On February 22, Council will receive the final report on an audit of the Charlottesville Affordable Housing fund.

(See also: Council briefed on affordable housing funds, December 31, 2021)

Payne also wants additional local funding for public transportation as one way to implement a future climate action plan. He also wants money set aside for higher salaries when the city implements a collective bargaining system for city employees.

Councilor Brian Pinkston said he supports funding for the school.

“Local governments build schools,” Pinkston said. “That’s like a core competency of what we should be doing to advance. It’s more than just building shiny new buildings. There’s an investment in physical capital that reflects human capital as well.”

Pinkston asked the public to accept the potential to reduce the cost of reconfiguration through value engineering discussed at Council’s joint meeting with the School Board on Wednesday. He also said he supported continued spending on affordable housing.

Charlottesville Mayor Lloyd Snook agreed that it is the role of the city to invest in schools, and that Councilors in recent years have seen providing affordable housing as a core city function.

“That not withstanding, this Council and prior Councils have decided that it is something that is a priority of ours and it gets hard after a while to figure out what it means to be one of those core things that cities have to do if we keep adding more things to that list,” Snook said.

Snook said collective bargaining will also lead to the need for more employees to handle the negotiations, and that will be another added moving forward. Charlottesville has also taken additional EMS positions paid for through a federal grant that will eventually run out.

“Part of the issue there of course is the ongoing concern that has not really been addressed at all between the Rescue Squad and the Fire Department and that’s an issue that we need to be working on whether that has an actual budget impact on the next fiscal year , I don’t know,” Snook said. “It seems to me that it may well.”

The draft capital improvement program shown to the Planning Commission in November anticipated issuing bonds for the school reconfiguration project in FY2024, which means a tax increase this year to pay for the debt service would not be strictly necessary. But Hammill said saving up the money now could help the success of the project.

“I do think that if we had an opportunity to decide where we are definitively, then there is a lot of opportunity for staff to come back and give you more definitive options to weigh against,” Hammill said.

Councilor Payne said he wanted to see scenarios for various situations ranging from cutting the budget to adding more revenue.

“And I think within those scenarios has to be not just what we choose to find in the CIP but also the other variable of is a majority of Council in support of a ten cent real estate tax increase?” Payne asked. “Fifteen? Twenty? Five?”

Payne suggests other revenue sources

Payne is also holding out hope that the General Assembly will grant permission to localities including Charlottesville to enact a one-percent sales tax increase for education. Legislation in the House of Delegates filed by Delegate Sally Hudson (D-57) did not make it out of committee (HB531) (HB545) but a bill carried by Senator Creigh Deeds (D-25) did pass out of the Senate on a 28 to 12 vote (SB298). Bills need to be approved by both Houses in order to go before Governor Glenn Youngkin for action.

“And the state’s commission on school funding was very explicit in saying that the only solution was state level,” Payne said.

Payne referred to the Virginia Commission on School Construction and Modernization, which offered several recommendations in December. (read them here)

Payne also suggesting finding a way to get the University of Virginia to contribute to the city through something called a Payment in Lieu of Taxes which you can look up in the state code.

“It’s longer term but it seems like a discussion we should engage the University on,” Payne said. “I know that’s something that the University of Michigan, Yale, Harvard, and many other institutions have done.”

UVA is exempt from paying property taxes and none of the examples he gave are in Virginia.

Rogers took all of the information in.

“It’s a lot to think about and we appreciate that and this part of the program was precisely what we had hoped for,” Rogers said.

Deadline looms for tax rate advertisement

A tax rate has to be advertised to the public thirty days before the public hearing and Hammill said that means a decision on a tax rate to publish needs to be made by Council by February 14.

“February 14 is the day I really need to be calling up the Daily Progress so we’re short on time in that respect,” Hammill said.

Mayor Snook said that Council will make a final decision on the tax rate to advertise at its meeting this upcoming Monday.

After a public comment period, they further discussed the matter.

Councilor Payne suggested one scenario.

“If our baseline scenario is funding everything currently in the CIP, I would think that at a minimum we would need to discuss ten cents,” Payne said. “If we’re talking about five cents or lower, again, I think we just need to be very honest with ourselves and the public that that means not funding the affordable housing plan for a decade.”

Payne also said without a higher tax increase, there would be no funding to expand transit, address climate change, begin collecting bargaining, and continued support for Friendship Court’s redevelopment.

“And I don’t think that’s what the community wants to see our decision to be,” Payne said.

Another issue is whether Council should provide city funding two additional Piedmont Housing Alliance projects that they approved earlier this year.

(See also: Council approves MACAA rezoning for Piedmont Housing Alliance and Habitat for Humanity)

Magill was very clear.

“I am very much for raising taxes,” Magill said. “I think we have to do it for a lot of reasons.”

Pinkston said he needed more time to decide on a tax rate but appeared supportive of one.

“I don’t know all the reasons why our tax rates are relatively low,” Pinkston said. “You know, I’m open to a ten cent increase because I think that’s what it’s going to take to get where we need to go.”

Pinkston suggested five cents this year, and the other five cents next year.

Interim City Manager Michael Rogers closed up the meeting.

“We can take this and go back and Krisy and the revenue team and we can really dig in with the deputy city managers and try to come city manager is going to come back with something that will meet your needs,” Rogers said.

Share this post