Another week begins in a relatively new month and no matter what side of the Atlantic you are on, it is 4/4/22. This is also the 94th day of the year and we are now officially part a quarter of the way through. This is the relevant edition of Charlottesville Community Engagement, and I’m the usual host, Sean Tubbs.

On today’s show:

A fish kill is reported off Barracks Road in Charlottesville

Community engagement for Albemarle Comprehensive Plan review moves forwaard with new newsletter

The Pantops Community Advisory Committee is briefed on transportation projects

Charlottesville City Council briefed on capital projects and are presented with a potential scenario where a real estate tax will not need to be increased this year

First shout-out: JMRL Friends of the Library sale continues through Sunday

In today's first Patreon-fueled shout-out! Lovers of used books rejoice! The Friends of the Jefferson Madison Regional Library is back again with their annual Spring Book Sale opening this Saturday through Sunday, April 10! The Friends of the Library sale will once again take place at Albemarle Square Shopping Center from 10 a.m. to 7 p.m. each day.

Visit jmrlfriends.org to learn more! See you there!

Fishkill reported in Meadow Creek

The City of Charlottesville has reported the deaths in late March of hundreds of fish and other aquatic life in a section of Meadow Creek. Scientists with the Virginia Department of Environmental Quality evaluated the location near Cedars Court and found 842 dead fish, 130 dead salamanders, and 40 dead worms.

“Despite further exploration of potential sources by City staff, no source or responsible party has been identified,” reads the announcement that was sent out Friday afternoon. “It is likely that this is a case of illegal dumping of a chemical or toxic product.”

According to the report from the DEQ, there is no known source of pollution and the city will continue to monitor the area. The city worked with the Rivanna Conservation Alliance on the day the incident was reported by a community member, and found live creatures both upstream and downstream from the area, which is just to the north of the east wing of the Barracks Road Shopping Center.

Over a hundred people apply to be on AC44 working group

Albemarle County has begun the community engagement process for the Comprehensive Plan review, which is currently in the first of four phases.

“Behind the scenes, our project team has continued to gather data on existing conditions and recent trends in the county,” reads the first newsletter for what’s being called AC44. “This data is focused on the ways community members live, work, and travel in Albemarle County and how and where we may have room to grow within our existing Development Areas.”

The first phase is called Plan for Growth and is intended to review Albemarle’s Growth Management Policy, which are available for review on the AC44 website. A public survey on this will go live on April 29.

Over a hundred people have applied to be part of the working group that will oversee the work and staff are reviewing the applications.

Sign up for the newsletter on the Albemarle County website to get more information.

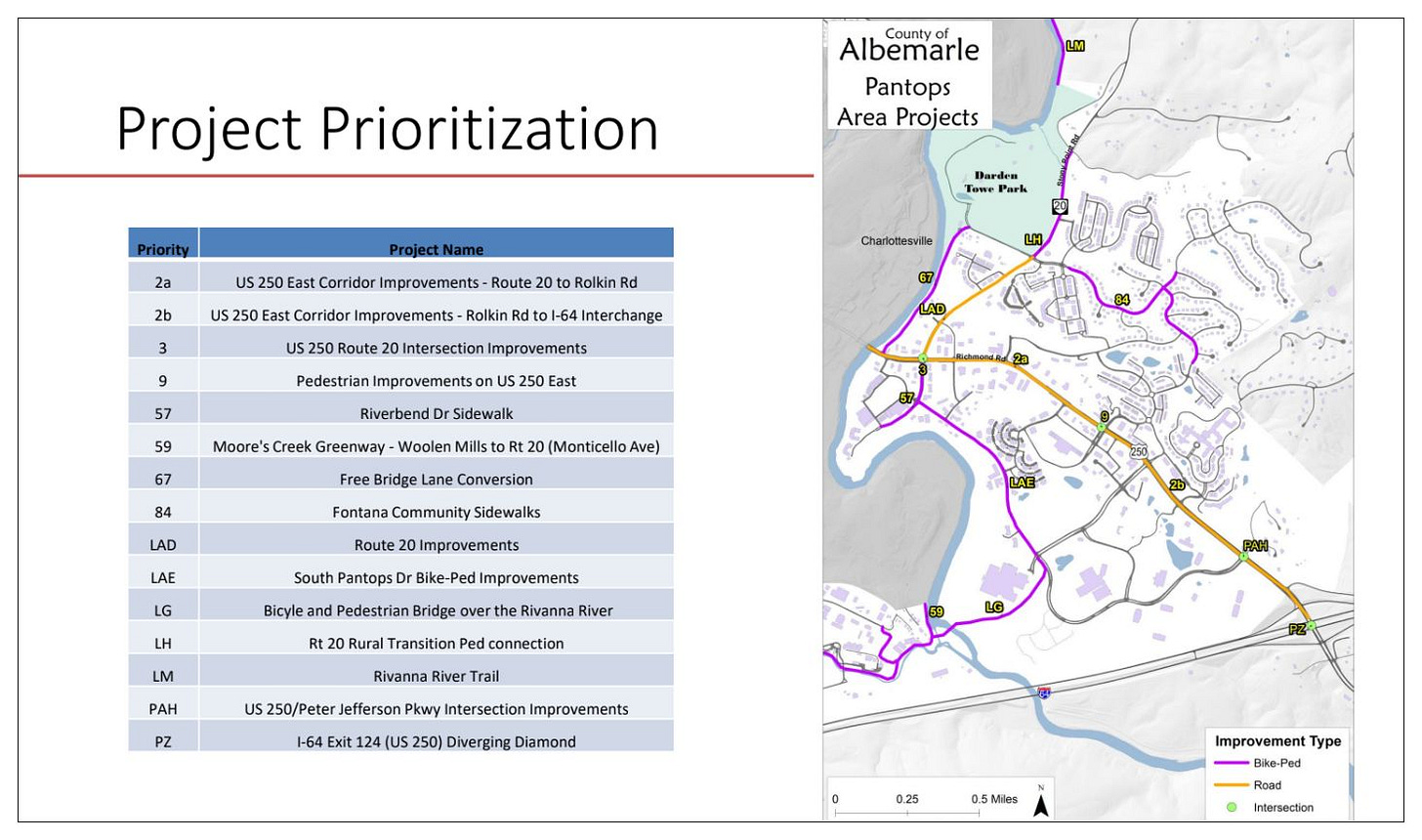

Pantops group briefed on transportation projects

In March, Albemarle’s growth area advisory committees learned about the county’s transportation process, and got updates on area projects. Albemarle keeps a list of projects that have been identified to address congestion issues, improve public safety, increase economic development, and achieve other goals.

“The last it was updated was in 2019, but we are embarking on another update and a reprioritization over the next year or two combined with the Comprehensive Plan update,” said Jessica Hersh-Ballering is a principal transportation planner for Albemarle County.

A project to make changes at the intersection of U.S. 250 and Virginia Route 20 was funded via Smart Scale in the third round. A sidewalk will be added in front of the McDonalds in the northwest quadrant of the intersection. (read the application)

“It would add a two-stage pedestrian crossing of U.S. 250 on the east leg,” Hersh-Ballering said. “Additionally this project will add a right turn lane for westbound vehicles on U.S. 250 that are trying to turn right or north onto Route 20.”

Changes to the signalizations and the geometry will be made as well to increase the number of vehicles that can make each signal cycle. However, this project won’t begin until winter of 2025 with a public hearing scheduled in the summer of 2023.

“But, still great because the project is fully funded and it will be happening,” Hersh-Ballering said.

A second Smart Scale project will see corridor improvements made to the east of that intersection up to Hansen Mountain Road. This access management project will be built around the same time.

“VDOT is fast-tracking this project so that it can be on the same schedule as the previous project and also so that both projects can use the same construction contractor and what that will do is allow overall cost efficiencies for bother projects,” Hersh-Ballering said.

The center turn lane will be replaced with a concrete median with specific openings for turns.

Several projects are currently seeking funding, such as sidewalk improvements on U.S. 250 and a pedestrian crossing at Rolkin Road. Another would make changes at the intersection with Peter Jefferson Parkway that could involve a park and ride lot.

Hersh-Ballering also gave an update on the proposed pedestrian bridge across the Rivanna River. Last month, the Metropolitan Planning Organization Policy Board has selected an alignment that will connect the former State Farm Headquarters with the Woolen Mills at the Wool Factory.

The county will also launch a microtransit service in the Pantops area that would be more like a ride-sharing service than fixed-transit.

“While it works like Uber, and you can request a ride, it still functions as a public utility,” Hersh-Ballering said. “The vehicles that pick you up are not going to be anyone’s personal private vehicle. It is a transit vehicle and it will always be ADA accessible.”

There will also be no surge pricing. For more details view the video on YouTube. So far it’s had one view. Let’s get that number up seven through the CCE bump!

Second shout-out to the ACHS’s Race and Sports Event tomorrow night

Today’s second subscriber-fueled shout-out is for an upcoming panel discussion on local history on Tuesday, April 5. The Albemarle Charlottesville Historical Society continues its Race and Sports project with a discussion with former star athletes and high school and college coaches. Dr. Shelley Murphy will moderate a panel with Wade Tremblay, Garwin DeBerry, and George Foussekis. They’ll share their stories and experiences during the desegregation of local public schools in the 1950s and 60s. The virtual event is available through Zoom registration and on Facebook Live.

Eight days until Charlottesville City Council adopts a budget

There are eight days left until Charlottesville City Council will adopt a budget for the next fiscal year, and many remaining decisions have yet to be made on tax rates.

Will there be an increase in the city’s real estate tax increase? Council can increase to as high as $1.05 per $100 of assessed value.

Will the city lower the personal property tax rate on vehicles to provide relief in the face of climbing values? The Commissioner of Revenue has recommended doing so, but leaving it at $4.20 per $100 of assessed value would bring in $2 million in additional revenue.

Will Council agree to a half percentage point in the meals tax? There’s a public hearing on this tonight.

Charlottesville City Council meets twice this week, and once again on April 12 to formally adopt the budget, which is larger than presented in March due to higher revenue projections.

Council met three times last week, including a work session on he capital improvement program on March 31 at which city staff indicated there may be more money available to support Council initiatives.

“That’s roughly about $3.7 million that we can add to the FY23 budget,” said Krisy Hammill, the city’s Senior Budget Management Analyst.

More on those details in a moment. This is a long one.

Capital Improvement Program recap

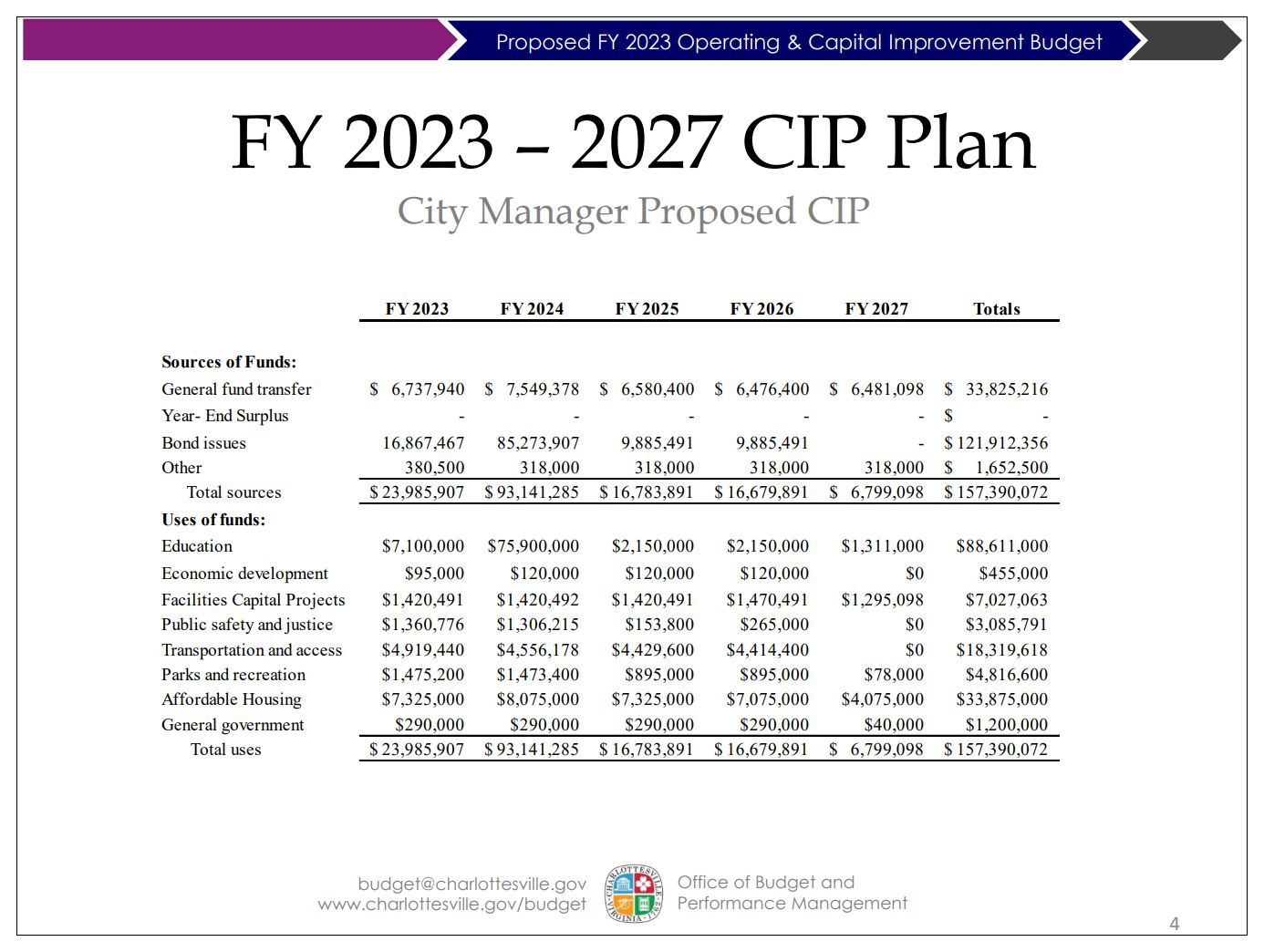

The March 31 work session was a chance for Hammill to go through the nearly $157.4 million five year plan in detail. (read the presentation)

The draft five-year CIP recommends $75 million for school reconfiguration, and the budget recommended by staff anticipates $2.5 million of that being allocated in FY23 and the rest in FY24.

It should be noted that Council can only make final decisions about the next fiscal year, and it will be up to their future counterparts to make the next set of choices. Over time, economic conditions will change.

The capital improvement plan does have projects that were approved by previous Councils and that budget staff have factored into the overall plan but for which bonds have not yet been sold.

Any Council can end those projects and transfer the paper money to another, such as last year when Council directed staff to take $18.6 million from the West Main Streetscape project and put it toward school reconfiguration.

The current schedule anticipates the issuance of nearly $16.9 million in bond sales in calendar year 2023.

Reviewing Planning Commission recommendations

Council was also briefed on recommendations from the Charlottesville Planning Commission on the CIP, including one that sought to overturn a decision made by Council five years ago to purchase property on East Market Street for a future parking structure.

See also:

Charlottesville PC recommends adjustments to FY22 Capital Budget, including defunding parking garage, February 10, 2021)

Charlottesville PC recommends more funding for affordable housing, new sidewalks, December 16, 2021)

“They recommended that existing and requested parking structure funding be reduced to a minimum so we basically removed all of the funding that was originally proposed in 23,” Hammill said. “It was remaining at $1.3 million. We took all of that out so if you look at this current draft there is no additional money for the parking structure.”

The city paid $2.85 million for the property and the idea had been to tear down two commercial structures and consolidate the lot with one next door to build a garage to support an expanded courts complex to serve both Albemarle and Charlottesville. Under the terms of an agreement signed in December 2018, the city must provide a certain amount of spaces to Albemarle.

“My understanding is that we’re still in discussions with the county on the path forward there, but there are no new dollars,” Hammill said.

The city has a balance of $2.8 million for the parking garage, according to economic development director Chris Engel. Again, this funding represents bonds previously authorized by Council but not yet sold.

Hammill said staff were able to accomplish some of the Planning Commission’s other requests such as fully funding the city’s efforts to treat and remove Ash Trees at a level of $105,000 a year as well as increasing funding for new sidewalks to $100,000. They also recommended decreasing funds for other categories, such as economic development strategic initiatives, small area plans, and implementation of the Strategic Investment Area.

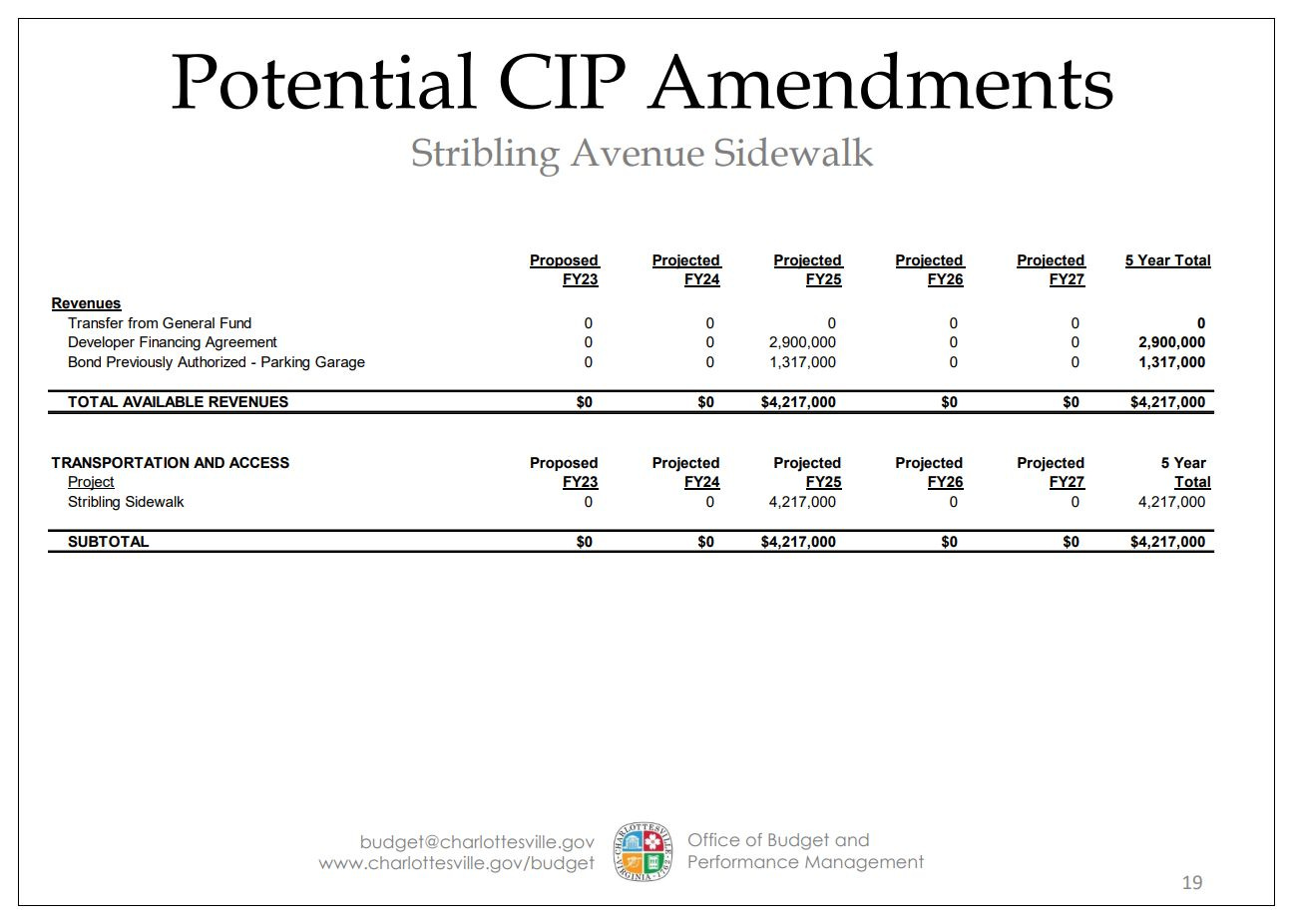

New pathway forward for Stribling sidewalks

Other projects that have been discussed since the budget was introduced in early March include $4.9 million to cover the city’s cost to build a sidewalk on Stribling Avenue as well as new section of the Meadowcreek Trail.

See also: City Manager Rogers to negotiate with Southern Development on Stribling sidewalk agreement, March 25, 2022

Hammill suggested taking the $1.3 million from the parking garage and assigning that to the Stribling Project plus an agreement with Southern Development to pay a $2.9 million loan to city to build the project in order to support a rezoning for 170 units.

“And that would actually get you to a point where you could add that project and given the timing from the developer and otherwise, that is more suited for an FY25 add than a FY23,” Hammill said.

It must be noted that Fiscal Year 2025 begins on July 1, 2024. Budgets are confusing.

The city is still in negotiations with Southern Development with the details and the rezoning will return to Council at a later date.

“We are definitely facing well over a year of planning on this sidewalk project,” Sanders said. “It is that complicated.”

There are nearly $5 million in requests from the Piedmont Housing Alliance to help subsidize the cost of new units on Park Street.

Tax rate scenarios could lead to new real estate tax rate increase this year

Toward the end of her presentation, Hammill showed multiple scenarios for school reconfiguration, some of which are built on Council agreeing to a total of $68.8 million for that purpose.

This anticipates the use of $7.5 million in American Rescue Plan Act funds received by the school system as well as the use of $6.7 million from the city’s surplus from Fiscal Year 2021.

While Hammill showed two scenarios that include at least a five cent increase in the real estate tax rate, she also suggested the city may have more money than originally suggested.

Hammill also discussed increases in revenues for FY23, including an additional $900,000 for sales tax, $500,000 for the lodging tax, and $25,000 for the meals tax.

“We’ve bumped those up some based on our current collection rate,” Hammill said. “We continue to see growth in those and we continue to see recovery at a faster rate than we had originally anticipated.”

Council could also choose to not lower the personal property tax rate, as Commissioner of Revenue Todd Divers has suggested. All told, the city’s anticipated revenues are higher than presented in early March.

“That’s roughly about $3.7 million that we can add to the FY23 budget,” Hammill said.

Those higher than anticipated revenues are also affecting the current year and Hammill said there is currently a projected surplus of $12.4 million in revenues.

“If you were to decide to do a tax increase that would also be an impact on FY22 and that number would go up,” Hammill said.

That’s because the tax rate applies to the calendar year, not the fiscal year.

In addition, the city also has a CIP contingency account that has a balance of around $11.4 million. Some of this funding could be applied to some of the priorities and Council faces several choices for how to proceed, such as using some of the contingency to cover the Piedmont Housing Alliance requests?

“I like the opportunity to have options,” said Vice Mayor Juandiego Wade.

Councilor Brian Pinkston sought clarification if Hammill was suggesting that the city could use those funds to avoid an increase in the real estate tax this year.

“That is one option,” Hammill said. “The risk here is that something could happen and these two years, this surplus maybe does not materialize.”

Surplus funds cannot be used and allocated until they have been independently audited which usually happens in December.

Mayor Lloyd Snook said the surplus could be used to cover the costs of future debt services in the future.

“What that does is, A, it buys us a year before we have to decide whether to raise the tax rate, which also buys us some time to see if the General Assembly folks can pull some magic out of a hat for a sales tax increase,” Snook said.

Snook said he would prefer not to raise the real estate tax rate in a year when assessments are up over ten percent.

Councilor Sena Magill repeated her desire for a real estate tax increase this year.

“I would feel more comfortable if we had one cent at least that we are putting toward the school fund,” Magill said.

Councilor Michael Payne also supported a tax increase this year to ensure the city can increase spending on affordable housing, transit, and collective bargaining.

“I would think that a real estate would be less regressive than the meals or the personal property tax and that we should be looking at that,” Payne said.

Tonight’s public hearing is on the meals tax and there will be a budget work session on Thursday.

“I would hope that meeting would be the meeting where we would finally hash out the details and we would come at the end of the meeting with an agreement,” Snook said.

Support Town Crier Productions!

Special announcement of a continuing promo with Ting! Are you interested in fast internet? Visit this site and enter your address to see if you can get service through Ting. If you decide to proceed to make the switch, you’ll get:

Free installation

Second month of Ting service for free

A $75 gift card to the Downtown Mall

Additionally, Ting will match your Substack subscription to support Town Crier Productions, the company that produces this newsletter and other community offerings. So, your $5 a month subscription yields $5 for TCP. Your $50 a year subscription yields $50 for TCP! The same goes for a $200 a year subscription! All goes to cover the costs of getting this newsletter out as often as possible. Learn more here!

Share this post