In today’s Patreon-fueled shout-out from an anonymous supporter: It may seem like we just had an election, but 2021 is once again a city, county, and state election year. Party primaries are coming soon on June 8, 2021. The deadline to register to vote, or update an existing registration is Monday, May 17, 2021. Visit the Virginia Department of Elections to learn more at .elections.virginia.gov.

On today’s show:

Campaign finance reports are in for candidates in Albemarle and Charlottesville

A developer of below-market housing units explains some of the financial details

The Free Enterprise Forum takes a look at the make-up of local government revenues

The first campaign finance reports are in for the Charlottesville City Council race and the Albemarle County Board of Supervisors. The Virginia Public Access Project has updated their campaign finance database with new reports from all of the Democrats who have filed in both races.

Let’s start with the two seats for City Council. City Councilor Heather Hill is not running for re-election. Independent Mayor Nikuyah Walker announced re-election last year, but the Virginia Public Access Project does not yet include a report from her campaign.

Four-term Charlottesville School Board member Juandiego Wade raised $55,544 in the first quarter of the year, with 77 contributions of over $500. That includes one $5,000 donations from Sonjia Smith and another $5,000 from Seminole Trail Management LLC. So far Wade has spent $13,893.

Brian Pinkston, who ran for the Democratic nomination in 2019, raised $40,578 between February 7 and March 31 according to material published on VPAP. That includes 53 contributions of more than $100 including a $5,000 contribution from Seminole Trail Management LLC. Pinkston has spent $828 in itemized expenses and the total amount raised includes $7,685 in in-kind expenses.

The report from Charlottesville Businessman Carl Brown shows the candidate has raised no money and spent no money, and has a campaign balance of $25.

The VPAP update also does not include a report from independent candidate Yas Washington.

In Albemarle County, there are reports for the three Democrats in the three magisterial district races. So far there are no independents or Republicans.

Newcomer Jim Andrews raised $25,876 in his campaign to succeed Liz Palmer as the supervisor for the Samuel Miller district. That includes $2,518 from Liz Palmer’s campaign, and $5,000 donations a piece from Sonjia Smith and Michael Bills. Andrews’ campaign spent $928 and recorded $400 in in-kind expenses.

Jack Jouett District incumbent Diantha McKeel raised $11,605 in the first quarter, and had a balance of $25,543 on March 31. McKeel spent $532.

Rio District incumbent Ned Gallaway raised no money in the first quarter but began the year with a balance of $5,693. His campaign spent $28.

So far, there are no independents or Republican candidates in any of the three supervisors races.

One of the biggest issues facing any of the candidates elected this November is housing. There are many calls for local governments to invest more in subsidizing the cost to provide units to people whose household incomes are below the area median income.

To educate policymakers throughout the wider area, the Central Virginia Regional Housing Partnership has been holding a speaker series to illustrate the challenges and obstacles from the perspective of the building and development community. Yesterday, on April 15, the guest was William Park, the president of Pinnacle Construction. He went through the many line items that go into a financial calculation about how much it costs to build new housing.

He said at the moment, one of the major factors is rising prices for materials, with some elements costing as high as four times as much as they did a year ago.

“Give you an example, I was just writing a purchase order the other day that I struggled to sign it,” Park said. “OSB 716 that we use many times for sheeting on our walls and our roofs. In an apartment project, we may have 30,000 sheets of OSB. Typically I’m in the $10 range. I signed a PO the other day for $42 a sheet.”

Another factors are permits, taxes, insurance, recording fees, financial statements, legal fees, and everything it takes in order to get a building permit.

“And then reserves that we have to set aside for working capital and initial operating deficit,” Park said.

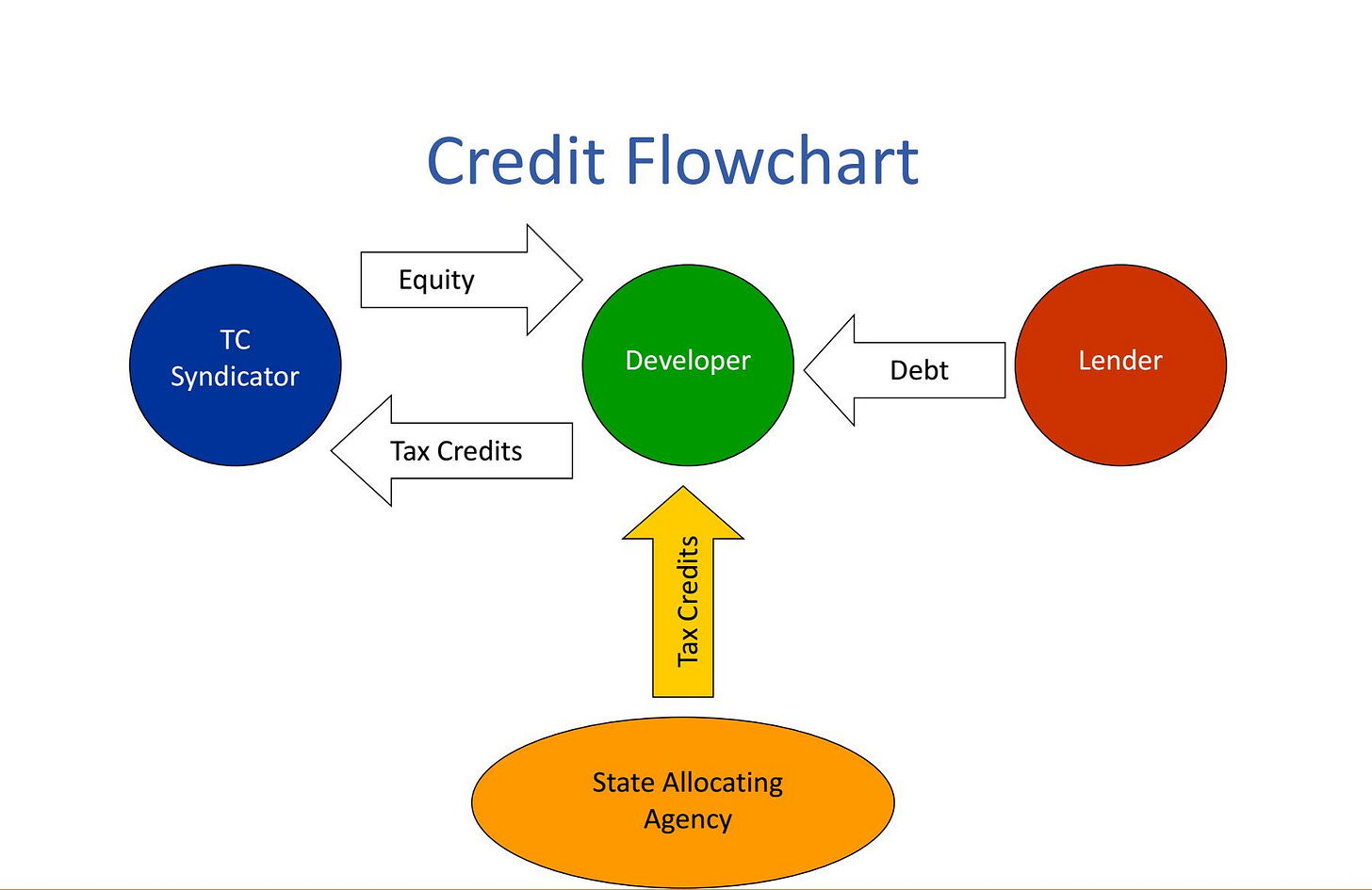

Park also detailed ways to help cover the costs in order to deliver housing units that can be rented out below what the market could bring in. These include grants from the federal or state government, as well as tax-exempt bonds from entities such as economic development authorities. Many projects Park has worked on involve Virginia Housing, formerly known as the Virginia Housing Development Authority.

“They get a large portion of the tax-exempt bond allocation that goes to the state,” Park said. “The other tool that we use almost extensively for anything below the 60 percent area median income is the low-income housing tax credit.”

You’ll often hear the acronym LIHTC for low-income housing tax credits. This has helped subsidize construction of “affordable” projects in Albemarle County ranging from Crozet Meadows to Wood’s Edge. In Charlottesville, recent projects with low-income housing tax credits include Carlton Views. There are different kinds of tax credits for different kinds of projects. (Virginia Housing page on low-income housing tax credits)

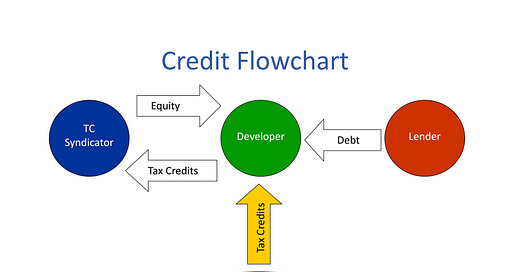

“If we’re allocated tax credits, we sell those tax credits to a corporate entity and they in return get a dollar for dollar credit against their federal tax liability,” Park said.

This builds equity in the project which brings down the amount that needs to be financed. This is a competitive process. In this year’s cycle, Virginia Supportive Housing is applying for tax credits for their portion of the redevelopment of the Red Carpet Inn. Piedmont Housing is applying for the tax credits for the 70 apartment units they are building at Southwood. (current applications)

Park said there are other options for projects that seek to provide an affordable rent for households who make between 60 percent and 80 percent of the area median income. Virginia Housing has a mixed-income financing program.

“They have a particular program where they use taxable bonds,” Park said. “Twenty percent would have to be set aside for those tenants at AMI 80 percent or less. The other 80 percent could be unrestricted as far as rents, or you could choose the 40/60 option which would be 40 percent below 100 percent AMI and the balance 60 percent unrestricted.”

The concept of “affordable housing” means different things to different people. Park said there are a lot of misunderstandings based on biases and prejudices.

“When the low-income housing tax credit was first promulgated, one of the worst things they ever did was entitle it the ‘low-income housing tax credit’ because I think at that point everybody thinks you’re talking about people that don’t work, that have no other chance to provide anything to society, which is totally wrong.”

Park said interventions to reduce rents provide places to live for service workers, including first responders and teachers. In an affluent community like Charlottesville, the area median income is high, at $93,900, putting many homes out of reach.

Park suggested ways to help developers lower the cost of projects include expedited initial reviews, reduced parking requirements, and increased building heights. He also said a less adversarial relationship between developer and local government would also help.

“The planning staff needs to be an advocate and really help get us through the process for this affordable housing because time is money and if we’re sitting there with a deal that we’ve looked at and the interest rate needs to be five percent, and all of a sudden this thing has taken eight or nine months to get through, and now interest rates are now six percent, well the deal may not work anymore, and that’s the reality of it,” Park said.

The full recording of the event will soon be made available on the YouTube page for the Thomas Jefferson Planning District Commission.

City Council adopted their budget for Fiscal Year 2022 this week, and we still wait to see the details on how a multimillion revenue shortfall will be closed for the current fiscal year. City Council will get an update on Monday. Albemarle will hold a public hearing on their budget on April 28 followed by adoption on May 5.

But how did things go in fiscal year 2020, which ended last June 30. The Free Enterprise Forum has released its annual revenue report which analyzes how each government in the planning district gets it tax money.

“The analysis seeks to develop comparative metrics to examine the taxation trends in each locality and determine if these trends can be correlated to other localities,” reads the introduction to the Revenue Report. “In addition, The Revenue Report seeks to promote understanding of the impact of business and economic development to diversify a locality’s tax revenue streams.”

The report found that Charlottesville gets 35.7 percent of its local tax revenue from commercial sources, including property taxes paid by businesses. That compares to 27.3 percent in Albemarle, nearly 8 percent in Fluvanna County, nearly 20 percent in Greene County, 13 percent in Louisa, and 20.4 percent in Greene.

For more on the report, check out the Free Enterprise Forum’s blog.

Share this post